Automated Financial Scoring: Optimizing Third-Party Assessment

In today’s world of interconnected supply chains, businesses can no longer afford to manage their supplier relationships blindly. A partner’s financial health can quickly become a critical risk factor.

This is precisely the view of procurement leaders, who rank the risk of third-party financial failure as their number one concern, according to the AgileBuyer study.

For organizations seeking to anticipate, secure, and optimize third-party management, integrating automated financial scoring into their TPRM (Third Party Risk Management) program is now a strategic choice.

Understanding the Importance of Financial Scoring in Third-Party Oversight

A supplier’s financial health goes beyond their ability to make payments. It also reflects their capacity to fulfill commitments, invest in innovation, or adapt to regulatory changes. A struggling partner can cause delays, hidden costs, or even critical disruptions to your value chain. And in a world where third-party-related disruptions are on the rise, one-time assessments are no longer enough.

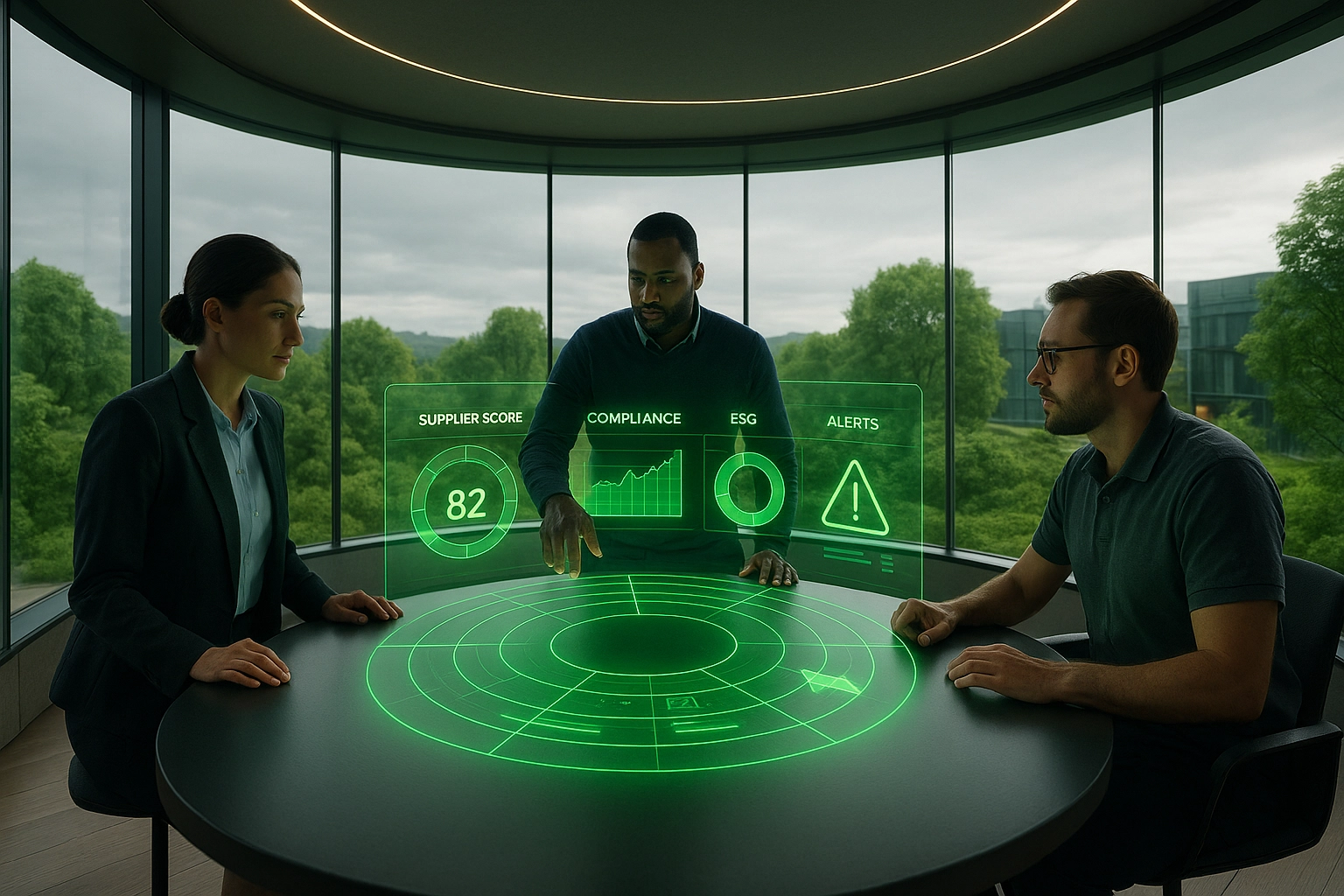

That’s where automated financial scoring comes in. Unlike traditional manual and inconsistent evaluations, this method uses algorithms to analyze a company’s key financial indicators in real time. The result: a dynamic, predictive, and actionable view of each partner’s financial health.

Key Benefits for Organizations

1. Proactive Risk Reduction

By using automated scoring, companies can detect early warning signs: cash flow issues, payment delays, loss of major contracts… This ability to anticipate trouble is crucial to avoid unpleasant surprises during contract execution or at renewal stages.

2. Real-Time Monitoring and Faster Decisions

Automated scoring turns a static snapshot into continuous tracking. This ongoing monitoring enhances team responsiveness and supports faster, more informed decisions—based on up-to-date, objective data.

3. Greater Efficiency and Lighter Internal Workload

Digitizing the evaluation process significantly reduces the administrative burden on procurement, finance, and compliance teams. Analyses are automated, alerts are generated in real time, and reports are embedded directly into business tools—without overburdening suppliers, thus limiting supplier fatigue.

4. Standardization and Transparency

Evaluation criteria are consistent and documented. This ensures a fair and uniform approach across all third-party partners, regardless of size or sector. A standardized method also simplifies internal audits and regulatory reviews.

A Mature Technology, Adaptable Across All Sectors

Financial scoring solutions are no longer limited to financial institutions. In the public sector, local authorities already use these tools to secure procurement and prevent execution failures. In industry and retail, these technologies help identify vulnerable subcontractors and reinforce critical links in the supply chain.

Go Further

Platforms like Aprovall360 support over 450,000 third-party partners worldwide with continuous evaluation, offering seamless, compliant, and well-documented financial data processing.

How Does an Automated Scoring Solution Work?

The process typically follows four key steps:

- Automated collection of financial data, from public sources (financial statements, reports, credit ratings) or private sources (internal data, partner alerts)

- Algorithmic analysis, using predictive models trained to detect trends, anomalies, and complex correlations

- Dynamic scoring, adjusted based on evolving data and sector context

- Real-time alerts, notifying of significant risk profile changes

Everything is centralized into custom dashboards, accessible to relevant stakeholders (buyers, risk managers, compliance officers, etc.).

Insights from Altares D&B

The goal of Altares D&B’s financial failure score is to help clients tailor their business relationships based on the financial risk across their entire portfolio. The performance of this score is ensured by:

- Automated, industrial-scale data collection from over 900 sources

- A robust quality process to validate and correct data (including open data) via a Data Quality Management (DQM) system

- Continuous scoring updates across the full accessible business landscape

Thanks to these high standards, we deliver clear, actionable insights to support your decision-making.

Gilles Lambert – Product Marketing Manager, Finance Solutions

Maintaining Human Oversight: The Key to Balance

Even though automation brings speed and reliability, human expertise remains essential to interpret results in context, spot potential biases, and incorporate qualitative factors. The “human-in-the-loop” approach, recommended by institutions like the World Economic Forum, ensures a healthy balance between technological power and strategic judgment.

Shared Benefits with Suppliers

Far from being a burden, integrating scoring into your TPRM program can also benefit your third-party partners:

- Fewer redundant requests thanks to centralized data

- Greater transparency, with visibility into the evaluation criteria

- Opportunities to co-create improvement plans based on shared insights

It becomes not only a risk management tool, but also a platform for dialogue and collaboration.

What’s Next for Automated Financial Scoring?

Automated financial scoring is just one building block in a broader third-party governance strategy. In the future, these solutions will increasingly incorporate:

- ESG indicators, for a more holistic view of partner responsibility

- Explainable AI (xAI) models, for greater transparency in automated decisions

- Sector-specific frameworks, adapted to each industry’s realities

- Shared analytics ecosystems, to facilitate evaluation pooling across client networks

These advancements will help organizations build stronger operational resilience in an increasingly uncertain business environment.

By integrating automated financial scoring into your TPRM framework, you’re not just checking a compliance box. You’re creating the foundation for more balanced, reliable, and long-lasting supplier relationships. You’re securing your operations, optimizing internal resources, and improving decision-making.

In short, you’re turning third-party management into a performance driver, not a constraint

These articles might interest you

-

18 April 2025ESG Strategy for the Supply Chain: Assessment and Management MethodsSolutionsThe ESG strategy (Environment, Social, Governance) has become a fundamental pillar of corporate operational resilience. According to the 2025 Supply Chain ESG Risk Outlook by LRQA, over half of sourcing countries are now classified as high or extreme ESG risk, challenging the common perception that Western markets are inherently safer. This new reality demands a […]

18 April 2025ESG Strategy for the Supply Chain: Assessment and Management MethodsSolutionsThe ESG strategy (Environment, Social, Governance) has become a fundamental pillar of corporate operational resilience. According to the 2025 Supply Chain ESG Risk Outlook by LRQA, over half of sourcing countries are now classified as high or extreme ESG risk, challenging the common perception that Western markets are inherently safer. This new reality demands a […]Read more

-

16 January 2025TPRM Platform: Essential Features for Modern Third-Party Risk ManagementSolutionsAs third-party risk management becomes a strategic priority, TPRM platforms (Third Party Risk Management) are emerging as a must-have standard. This shift responds to a dual imperative: ensuring operational continuity and meeting increasingly complex multi-country regulatory compliance. With over 430,000 third-party vendors assessed across Europe, Aprovall’s experience has helped define the essential features of a modern TPRM platform—now evolving into a broader […]

16 January 2025TPRM Platform: Essential Features for Modern Third-Party Risk ManagementSolutionsAs third-party risk management becomes a strategic priority, TPRM platforms (Third Party Risk Management) are emerging as a must-have standard. This shift responds to a dual imperative: ensuring operational continuity and meeting increasingly complex multi-country regulatory compliance. With over 430,000 third-party vendors assessed across Europe, Aprovall’s experience has helped define the essential features of a modern TPRM platform—now evolving into a broader […]Read more

-

06 February 2025Effective Third-Party Governance: A Holistic Approach to Optimized Risk ManagementSolutionsIn a context where 38% of companies have experienced major disruptions due to third-party partners over the past three years, third-party governance is becoming a strategic imperative. This reality is even more critical as 90% of organizations now consider third-party risk management a growing priority. Effective third-party management relies on a holistic approach integrating six key areas of expertise: Legal […]

06 February 2025Effective Third-Party Governance: A Holistic Approach to Optimized Risk ManagementSolutionsIn a context where 38% of companies have experienced major disruptions due to third-party partners over the past three years, third-party governance is becoming a strategic imperative. This reality is even more critical as 90% of organizations now consider third-party risk management a growing priority. Effective third-party management relies on a holistic approach integrating six key areas of expertise: Legal […]Read more

-

17 March 2025Understanding Third-Party Cybersecurity Maturity: Keys to Effective AssessmentSolutionsThird-party governance has become a major strategic issue in an economic context marked by the growing interdependence between companies and their external partners. According to Gartner, 45% of cyberattacks in 2025 will originate from third parties, highlighting the urgency of a structured evaluation approach. Operational resilience against these threats now requires a shift from simple […]

17 March 2025Understanding Third-Party Cybersecurity Maturity: Keys to Effective AssessmentSolutionsThird-party governance has become a major strategic issue in an economic context marked by the growing interdependence between companies and their external partners. According to Gartner, 45% of cyberattacks in 2025 will originate from third parties, highlighting the urgency of a structured evaluation approach. Operational resilience against these threats now requires a shift from simple […]Read more