European Deforestation Regulation (EUDR): What Companies Need to Know to Ensure Compliance

Global deforestation is one of the leading drivers of climate change and biodiversity loss. According to the FAO, nearly 10 million hectares of forest disappear every year, mainly due to agricultural expansion. As the world’s second-largest importer of embedded deforestation, the European Union has decided to act. It is in this context that Regulation (EU) 2023/1115, known as the European Union Deforestation Regulation (EUDR), was adopted. Its objective: to prohibit the placing on the EU market or export of products linked to deforestation after December 31, 2020.

But beyond its environmental goal, this regulation significantly transforms how companies manage their supply chains. It introduces new obligations around traceability, compliance, and due diligence that will affect all stakeholders—importers, manufacturers, distributors, and public operators.

Understanding the European Deforestation Regulation

The EUDR was published in the EU Official Journal on June 9, 2023, and entered into force on June 29, 2023. It applies to commodities most associated with deforestation:

- Palm oil

- Cattle

- Wood

- Coffee

- Cocoa

- Rubber

- Soya

The annex also includes derived products such as chocolate, paper, furniture, and certain cosmetics and hygiene products.

The regulation’s goal is clear: ensure that products consumed or exported from the EU do not contribute to deforestation or forest degradation.

Timeline and Deadlines

Although the regulation is in force, its effective application has been delayed by one year to allow companies time to prepare.

| Type of Company | Original Application Date | New Application Date |

|---|---|---|

| Large Enterprises | December 30, 2024 | December 30, 2025 |

| Micro, Small, and Medium-sized Enterprises | June 30, 2025 | June 30, 2026 |

From December 30, 2025, all large enterprises placing regulated products on the EU market must prove they are “deforestation-free.” SMEs will have an additional six months to comply.

Key Obligations for Companies

The regulation requires companies to implement a structured due diligence system to ensure product compliance and traceability.

1. Due Diligence

Companies must:

- Collect information about suppliers, material origins (plot-level geolocation), volumes, and local compliance.

- Assess the risk of deforestation or legal non-compliance in the country of origin.

- Implement mitigation measures such as audits, contractual guarantees, or enhanced monitoring.

2. Traceability

Each company must be able to geolocate the source plot of raw materials and prove no deforestation has occurred since December 31, 2020.

3. Legal Compliance

Products must comply with all relevant environmental, land use, and labor laws of the country of origin.

4. Declaration and Documentation

Before being placed on the market, a due diligence statement must be submitted to the European Information System. This document, accessible to authorities, proves product compliance.

5. Controls and Sanctions

Member States will conduct regular checks.

Non-compliance may lead to fines of up to 4% of annual EU turnover and even temporary bans on marketing the products.

These obligations are prompting companies to adopt TPRM solutions that automate third-party interactions and documentation.

Key Challenges in Achieving Compliance

1. The Complexity of Traceability

Obtaining reliable geolocation data—especially in long or informal supply chains—is a major challenge.

2. Inclusion of Small Producers

Local actors often lack the technical resources to comply and risk exclusion from the European market.

3. Cost and Administrative Burden

Audits, data collection, and system updates require significant effort.

4. Commercial Risk

Non-compliant products may be blocked at EU borders, leading to major economic impacts.

5. Varied National Approaches

Each Member State will apply the regulation based on its resources and priorities, creating potential disparities in enforcement.

How to Prepare Effectively

The key to EUDR compliance lies in anticipation and structure.

Companies should:

- Map their supply chain

- Identify affected products and suppliers

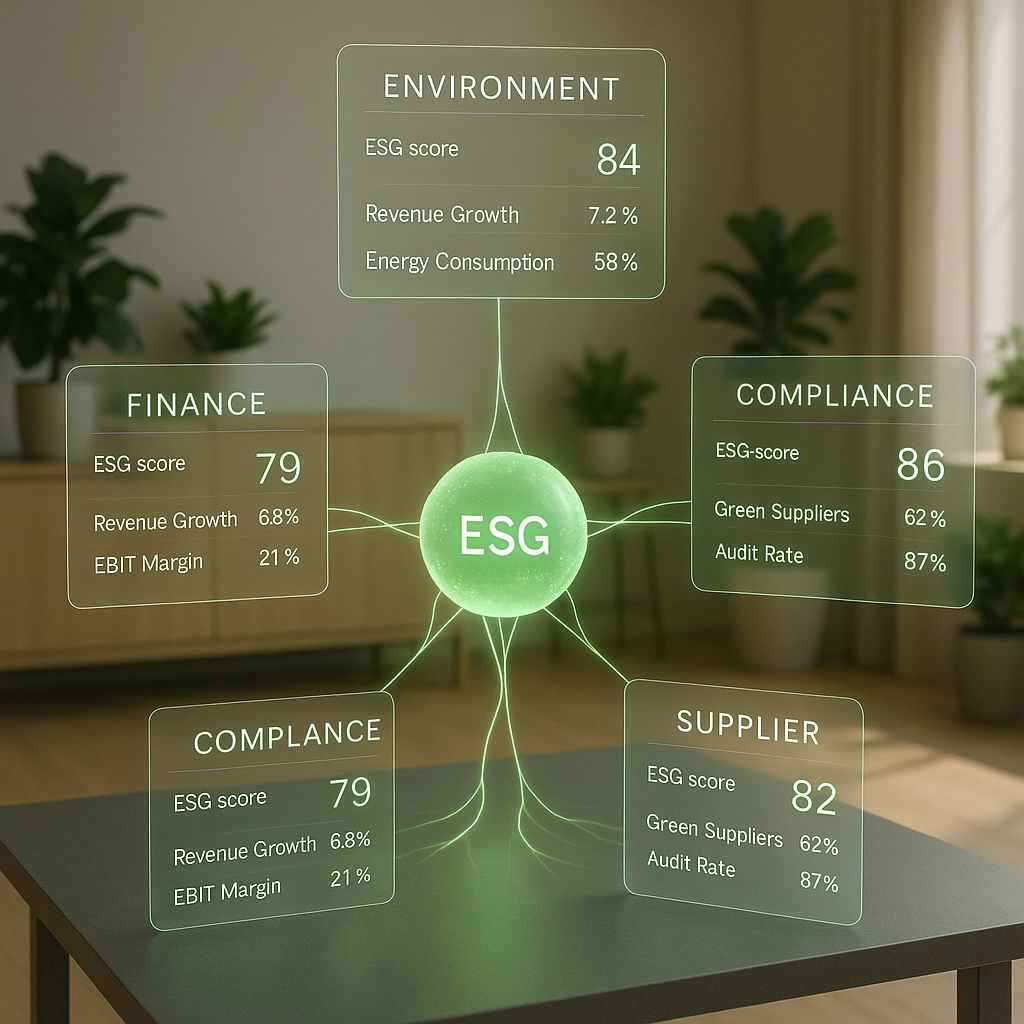

- Implement automated ESG and geolocation data collection systems

- Train internal teams

- Centralize all information in a unified platform

Solutions like Aprovall already enable digitization of these processes: third-party assessment, document traceability, compliance checks, supply chain mapping, and automated alerts.

A Broader Regulatory Ecosystem

The EUDR is part of a larger regulatory ecosystem, including the CSRD (non-financial reporting) and the upcoming CSDDD/CS3D (Corporate Sustainability Due Diligence Directive).

These regulations converge toward a shared ambition:

“Ensure that European companies operate in a sustainable, transparent, and human- and environmentally respectful manner.”

In other words, the EUDR is just the first step toward a responsible, verifiable European supply chain.

Ready to strengthen your third-party risk management program?

These articles might interest you

-

08 July 2025Why integrate media monitoring into your third-party evaluation?SolutionsWith the rapid acceleration of digital information and the proliferation of media sources, real-time monitoring of your third-party partners’ media presence has become a critical strategic issue. Media monitoring is now an essential part of collaborative evaluation processes for any analyst seeking a comprehensive view of third-party risk. Whether the information is positive or negative, […]

08 July 2025Why integrate media monitoring into your third-party evaluation?SolutionsWith the rapid acceleration of digital information and the proliferation of media sources, real-time monitoring of your third-party partners’ media presence has become a critical strategic issue. Media monitoring is now an essential part of collaborative evaluation processes for any analyst seeking a comprehensive view of third-party risk. Whether the information is positive or negative, […]Read more

-

23 April 2025ESG Platforms: Centralized Data for Sustainable PerformanceSolutionsThe growing interest of investors and businesses in Environmental, Social, and Governance (ESG) criteria comes with significant challenges in assessing third-party partners. According to the DLA Piper report, ESG evaluation of external providers has become critical, particularly with the CS3D directive (Corporate Sustainability Due Diligence) coming into force on July 25, 2024. This directive requires […]

23 April 2025ESG Platforms: Centralized Data for Sustainable PerformanceSolutionsThe growing interest of investors and businesses in Environmental, Social, and Governance (ESG) criteria comes with significant challenges in assessing third-party partners. According to the DLA Piper report, ESG evaluation of external providers has become critical, particularly with the CS3D directive (Corporate Sustainability Due Diligence) coming into force on July 25, 2024. This directive requires […]Read more

-

19 January 2025Aprovall’s Strategic Challenges under CSRDSolutionsFor Aprovall, which supports over 430,000 third-party partners across Europe, operational resilience is a major strategic priority. A recent study reveals that 55% of companies subject to CSRD face difficulties in managing data quality and consistency. In response, Aprovall’s dual ISO 27001/27701 certification provides a robust framework for ESG data governance. In the social housing sector, sustainable performance requires an integrated value chain […]

19 January 2025Aprovall’s Strategic Challenges under CSRDSolutionsFor Aprovall, which supports over 430,000 third-party partners across Europe, operational resilience is a major strategic priority. A recent study reveals that 55% of companies subject to CSRD face difficulties in managing data quality and consistency. In response, Aprovall’s dual ISO 27001/27701 certification provides a robust framework for ESG data governance. In the social housing sector, sustainable performance requires an integrated value chain […]Read more

-

30 September 2025Supplier ESG Evaluation: How to Take Your First Steps Without ComplexitySolutionsIn response to increasing regulatory demands (CSRD, CSDDD) and growing stakeholder pressure, organizations understand they must integrate ESG into their supplier management processes. Yet with evolving standards, a lack of appropriate tools, and competing priorities, getting started can quickly feel overwhelming. A Supplier ESG Project… That Often Gets Stuck Many procurement departments and ESG managers […]

30 September 2025Supplier ESG Evaluation: How to Take Your First Steps Without ComplexitySolutionsIn response to increasing regulatory demands (CSRD, CSDDD) and growing stakeholder pressure, organizations understand they must integrate ESG into their supplier management processes. Yet with evolving standards, a lack of appropriate tools, and competing priorities, getting started can quickly feel overwhelming. A Supplier ESG Project… That Often Gets Stuck Many procurement departments and ESG managers […]Read more