How TPRM Maximizes the Management of Class C Suppliers

The Class C Supplier Paradox

In most organizations, the management of Class C suppliers is built on a well-known paradox: they represent only about 20% of total procurement spend, but consume nearly 80% of the procurement team’s time. These suppliers, often non-strategic and outside of core production, generate a high volume of invoices, administrative tasks, and repetitive processing that weighs heavily on buyers’ day-to-day work. Their economic impact is low, but their sheer number creates a disproportionate workload.

Class C suppliers are typically defined by low purchase volumes, limited criticality to operations, and a restricted operational contribution. Yet, despite their relative importance, they make up the majority of the supplier panel. These are low-value actors whose management is still necessary—particularly for meeting regulatory obligations. Monitoring them requires numerous time-consuming tasks: document collection, follow-ups, social or tax certificate verification, data updates, mass invoice processing… all of which consume time without directly contributing to procurement performance.

Risk Management Is Still Essential

The paradox deepens when we consider the risks involved. Even if these suppliers are not strategic, they must still meet minimum compliance requirements. Buyers must verify legal obligations, monitor insurance, assess ESG risks, ensure basic cybersecurity measures, and avoid undeclared labor situations. The challenge lies in the fact that these “small” suppliers often respond late—or not at all—and their document completeness rate is structurally low. The result is a cascade of follow-ups and checks that heavily burden internal teams.

TPRM Solutions Streamline Class C Supplier Evaluations

This is exactly where TPRM (Third-Party Risk Management) solutions provide a structured answer. They automate the majority of tedious steps: onboarding is guided, document collection is automated, follow-ups are scheduled, and legal checks are performed continuously. This automation saves precious time and improves tracking reliability while making the process smoother for less engaged suppliers. Evaluations are also adapted to actual criticality levels, with simplified questionnaires designed to maximize completeness and avoid overburdening third parties.

Dedicated dashboards offer instant visibility into pending files, residual risks, expired documents, and the overall compliance status of the Class C portfolio. Finally, a lesser-known but crucial benefit lies in identifying the ownership structure of these smaller suppliers. Some of them turn out to be part of strategic groups or linked to key partners. Identifying these relationships helps streamline the panel, consolidate procurement, and avoid dependency or duplication.

Ultimately, managing Class C suppliers should no longer be seen as an administrative burden. With the right TPRM in place, organizations can reduce operational load, improve compliance, manage essential risks, and free up teams to focus on the suppliers who truly create value for the business.

And Why Not Outsource the Management of Class C Suppliers?

Some companies choose to fully outsource the management of their suppliers to specialized players like AGP. Supported by TPRM, ERP, and SRM solutions, these providers handle the entire relationship: from operational follow-up to order management and volume optimization. This allows for full oversight and more efficient management of your supplier ecosystem.

Ready to strengthen your third-party risk management program?

These articles might interest you

-

08 July 2025Why integrate media monitoring into your third-party evaluation?SolutionsWith the rapid acceleration of digital information and the proliferation of media sources, real-time monitoring of your third-party partners’ media presence has become a critical strategic issue. Media monitoring is now an essential part of collaborative evaluation processes for any analyst seeking a comprehensive view of third-party risk. Whether the information is positive or negative, […]

08 July 2025Why integrate media monitoring into your third-party evaluation?SolutionsWith the rapid acceleration of digital information and the proliferation of media sources, real-time monitoring of your third-party partners’ media presence has become a critical strategic issue. Media monitoring is now an essential part of collaborative evaluation processes for any analyst seeking a comprehensive view of third-party risk. Whether the information is positive or negative, […]Read more

-

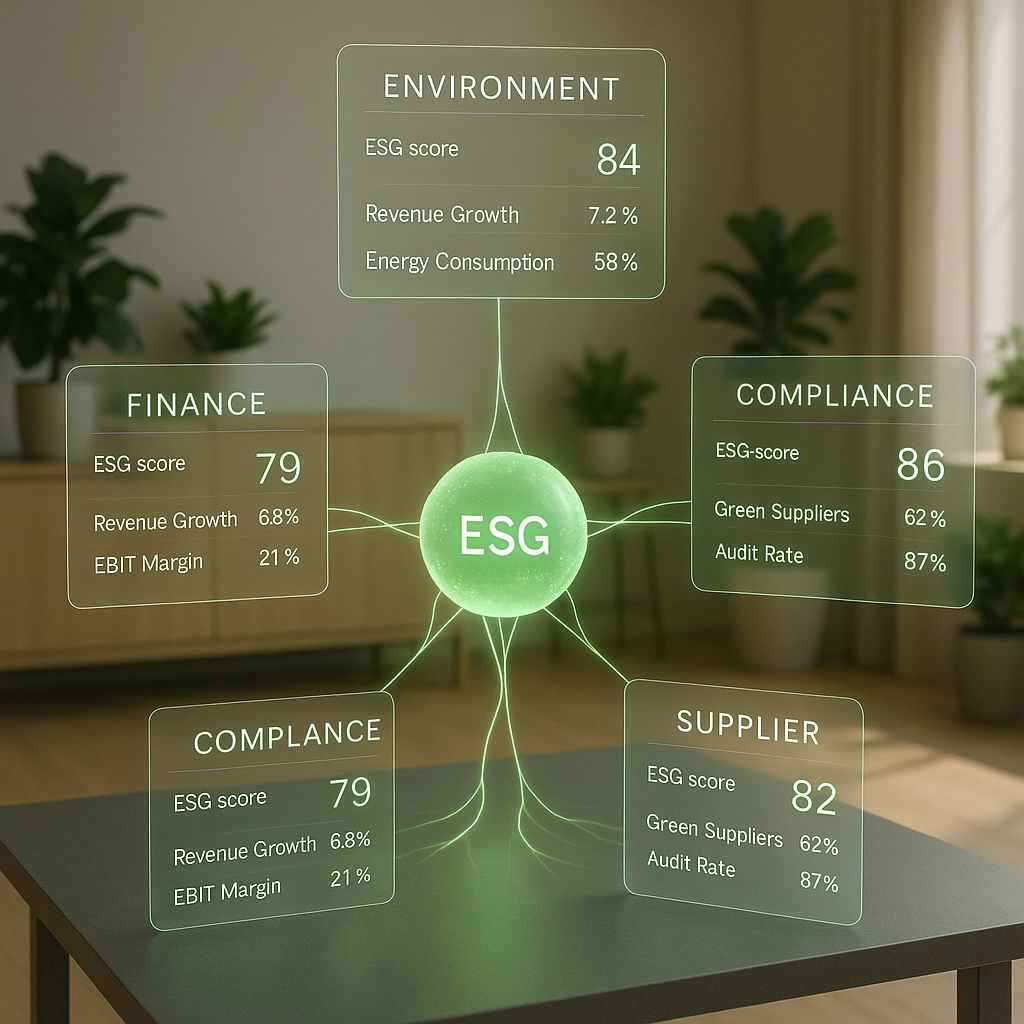

23 April 2025ESG Platforms: Centralized Data for Sustainable PerformanceSolutionsThe growing interest of investors and businesses in Environmental, Social, and Governance (ESG) criteria comes with significant challenges in assessing third-party partners. According to the DLA Piper report, ESG evaluation of external providers has become critical, particularly with the CS3D directive (Corporate Sustainability Due Diligence) coming into force on July 25, 2024. This directive requires […]

23 April 2025ESG Platforms: Centralized Data for Sustainable PerformanceSolutionsThe growing interest of investors and businesses in Environmental, Social, and Governance (ESG) criteria comes with significant challenges in assessing third-party partners. According to the DLA Piper report, ESG evaluation of external providers has become critical, particularly with the CS3D directive (Corporate Sustainability Due Diligence) coming into force on July 25, 2024. This directive requires […]Read more

-

19 January 2025Aprovall’s Strategic Challenges under CSRDSolutionsFor Aprovall, which supports over 430,000 third-party partners across Europe, operational resilience is a major strategic priority. A recent study reveals that 55% of companies subject to CSRD face difficulties in managing data quality and consistency. In response, Aprovall’s dual ISO 27001/27701 certification provides a robust framework for ESG data governance. In the social housing sector, sustainable performance requires an integrated value chain […]

19 January 2025Aprovall’s Strategic Challenges under CSRDSolutionsFor Aprovall, which supports over 430,000 third-party partners across Europe, operational resilience is a major strategic priority. A recent study reveals that 55% of companies subject to CSRD face difficulties in managing data quality and consistency. In response, Aprovall’s dual ISO 27001/27701 certification provides a robust framework for ESG data governance. In the social housing sector, sustainable performance requires an integrated value chain […]Read more

-

30 September 2025Supplier ESG Evaluation: How to Take Your First Steps Without ComplexitySolutionsIn response to increasing regulatory demands (CSRD, CSDDD) and growing stakeholder pressure, organizations understand they must integrate ESG into their supplier management processes. Yet with evolving standards, a lack of appropriate tools, and competing priorities, getting started can quickly feel overwhelming. A Supplier ESG Project… That Often Gets Stuck Many procurement departments and ESG managers […]

30 September 2025Supplier ESG Evaluation: How to Take Your First Steps Without ComplexitySolutionsIn response to increasing regulatory demands (CSRD, CSDDD) and growing stakeholder pressure, organizations understand they must integrate ESG into their supplier management processes. Yet with evolving standards, a lack of appropriate tools, and competing priorities, getting started can quickly feel overwhelming. A Supplier ESG Project… That Often Gets Stuck Many procurement departments and ESG managers […]Read more