TPRM vs Traditional Risk Management: A Critical Comparison for Modern Businesses

In a market valued at $8.3 billion in 2024 and projected to reach $18.7 billion by 2030, third-party governance is becoming a strategic pillar for organizations. In response to the rapidly evolving business world, Third Party Risk Management (TPRM) is profoundly transforming traditional risk management practices.

The traditional approach, focused on internal processes, is no longer sufficient to address the challenges of an interconnected economic ecosystem. Increasing interdependence among organizations demands a more sophisticated approach—one that incorporates the evaluation and monitoring of third-party partners.

Introduction to Risk Management

Businesses have always faced various risks that could compromise their operations. Traditional risk managementprimarily targets the identification, assessment, and mitigation of internal risks. However, as interdependence among companies grows, it’s become essential to also account for risks originating from external partners.

External stakeholders—such as suppliers, distributors, and service providers—play a critical role in daily business operations. This is where third-party governance comes into play, providing a more comprehensive and proactive approach to prevent potential incidents.

Key Differences Between TPRM and Traditional Risk Management

Scope and Focus

Traditional risk management is generally confined to internal processes and risks inherent to the organization itself. It aims to ensure compliance and responsiveness to threats identified within the company.

Today, 90% of organizations consider TPRM a growing priority, recognizing its crucial role in managing risks that extend beyond organizational borders. TPRM encompasses risk assessment related to interactions with third parties such as suppliers, logistics partners, and other external actors. This proactive approach enables better anticipation of issues resulting from interconnected value chains.

Risk Identification and Assessment

In traditional risk management, risk identification and assessment focus mainly on internal processes. Common tools include internal audits, SWOT analyses, and other organization-centered methods.

TPRM emphasizes predictive, collaborative evaluation, using intelligent document collection workflows to anticipate risks rather than simply react. This includes predictive analysis of financial history, monitoring of cybersecurity practices, and regulatory resilience assessments of third parties. The goal is to minimize risks originating from external sources.

Reactivity vs. Proactivity

Traditional risk management tends to be reactive—addressing threats after they’ve already caused damage or operational disruption.

In contrast, TPRM is proactive. By systematically monitoring third parties through collaborative evaluations, compliance reports, and other risk surveillance mechanisms, organizations can detect and mitigate issues before they escalate.

Organizations with high TPRM maturity show greater resilience and adaptability in a constantly shifting external environment.

Go Further

Read our customer stories to see how over 430,000 organizations in Europe have adopted a collaborative third-party evaluation approach using Aprovall, significantly reducing their risk exposure.

The Importance of Third-Party Governance

Operational Resilience

While 87% of organizations cite risk exposure reduction as their main TPRM goal, regulatory compliance remains a top concern for 65% of them. Various industries are subject to strict standards that require continuous monitoring of external partners. Non-compliance can result in severe penalties, further justifying the need for TPRM.

Integrated multi-regulation solutions now enable compliance with DORA, NIS 2, CSRD, and Sapin II, significantly reducing the regulatory burden.

Additionally, TPRM strengthens organizational resilience. Awareness of third-party risks and having mitigation plans in place helps companies recover quickly from disruptions. This is especially relevant in today’s uncertain economic climate, where supply chains are vulnerable to unexpected events.

Evangelizing TPRM

Personalized support helps companies naturally mature into third-party governance cultures. Evangelizing this practice means raising awareness across all organizational levels about the importance of TPRM. It also involves training teams to effectively use the necessary tools and methodologies.

Companies leading the way in TPRM adoption can serve as models for others—demonstrating how a well-crafted strategy can prevent crises and foster more transparent and reliable business relationships.

Strategies for Effective TPRM

Leveraging Advanced Technologies

To implement TPRM successfully, organizations must invest in advanced technological tools. These solutions often feature automated data collection, risk analysis, and reporting capabilities. They enable real-time monitoring of third parties, providing a clear, updated view of potential risks.

AI-driven risk evaluation platforms can detect weak signals that go unnoticed in manual reviews. They also offer predictive capabilities that enhance proactive risk management.

Collaboration and Communication

Another vital aspect of TPRM is close collaboration with third parties. Maintaining open, frequent communication ensures that partners adhere to the organization’s high standards of security and compliance.

Clearly defined contracts that outline risk management and compliance expectations are crucial. Conducting joint audits and sharing best practices also fosters trust and reduces unexpected surprises.

Key elements include:

- Initial partner selection and evaluation

- Continuous monitoring and regular audits

- Dynamic updates to risk criteria

- Transparent communication and best-practice exchange

Cas pratiques et exemples concretsPractical Use Cases

Manufacturing Sector

In manufacturing, relying on multiple raw material suppliers is common. A sudden production halt from a key partner can disrupt the entire supply chain. TPRM helps by routinely assessing the financial health and operational efficiency of third parties, ensuring supply continuity.

With increasing supply chain complexity and greater dependency on third parties for critical functions, a robust TPRM strategy is essential—especially in sectors like manufacturing, where ICPE and REACH compliance is vital.

For example, an automotive company might use TPRM to monitor the financial stability of parts manufacturers, identify production defect risks, and check environmental compliance. This continuous evaluation helps adapt procurement strategies based on identified risks.

Financial Sector

The financial sector heavily relies on third-party services for payment processing and client data management. TPRM assists financial institutions by implementing predictive evaluation and real-time monitoring procedures, especially in support of Know Your Supplier (KYS) protocols.

This is critical as third-party risks can include security breaches or regulatory violations. A real-life use case involves banks using TPRM to track cloud service providers’ performance and compliance. Quickly identifying vulnerabilities in third-party systems enables proactive measures to secure customer data.

TPRM stands apart from traditional risk management through its scope, methodology, and proactive stance. In an interconnected world, adopting TPRM is no longer optional—it’s essential for ensuring resilience and compliance.

Discover Aprovall360

The ISO 27001/27701 Certified Platform that guarantees data sovereignty while supporting your transition to EUCS standards.

The Shift Toward TPGRC

Third-party risk management is naturally evolving into a more integrated approach: TPGRC (Third Party Governance & Risk Control). This shift addresses emerging governance and compliance challenges in today’s complex business environment.

Toward Unified Governance

TPGRC enhances the TPRM framework by introducing a strategic governance dimension. It provides a consolidated view of third-party risks and performance while ensuring data sovereignty within the European context.

Technological Innovation

AI and automation are revolutionizing traditional document management. Intelligent workflows and predictive analytics now enable companies to anticipate—not just manage—risks.

Multi-Regulation Compliance

With an increasing number of regulations (DORA, NIS 2, CSRD), TPGRC offers an integrated response. Multi-regulation solutions help organizations meet various compliance requirements while streamlining internal processes.

Strategic Benefits

- Centralized risk data via unified dashboards

- Enhanced operational resilience

- Reduced organizational silos

- Real-time, data-driven decision-making

This evolution toward TPGRC presents an opportunity for organizations to turn risk management into a true driver of performance and innovation.

This evolution toward TPGRC presents an opportunity for organizations to turn risk management into a true driver of performance and innovation

These articles might interest you

-

08 July 2025Why integrate media monitoring into your third-party evaluation?SolutionsWith the rapid acceleration of digital information and the proliferation of media sources, real-time monitoring of your third-party partners’ media presence has become a critical strategic issue. Media monitoring is now an essential part of collaborative evaluation processes for any analyst seeking a comprehensive view of third-party risk. Whether the information is positive or negative, […]

08 July 2025Why integrate media monitoring into your third-party evaluation?SolutionsWith the rapid acceleration of digital information and the proliferation of media sources, real-time monitoring of your third-party partners’ media presence has become a critical strategic issue. Media monitoring is now an essential part of collaborative evaluation processes for any analyst seeking a comprehensive view of third-party risk. Whether the information is positive or negative, […]Read more

-

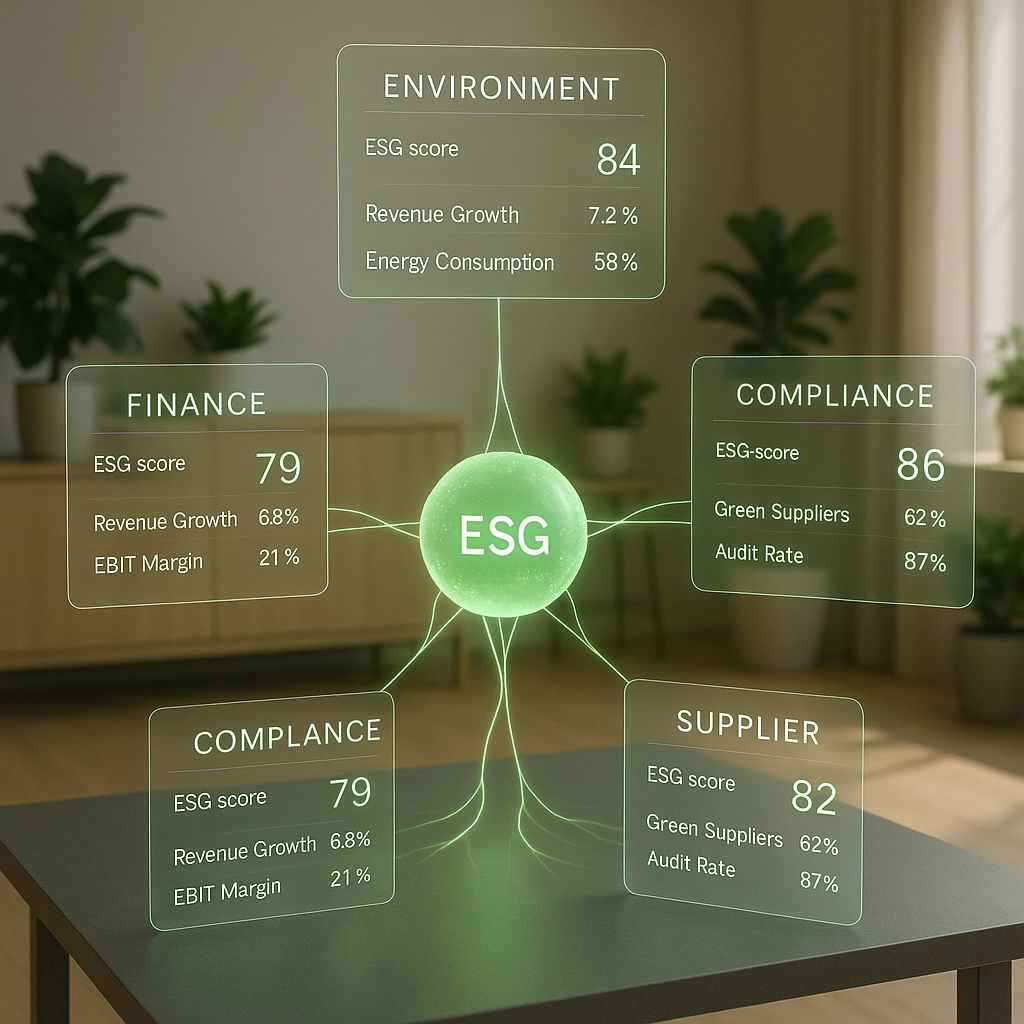

23 April 2025ESG Platforms: Centralized Data for Sustainable PerformanceSolutionsThe growing interest of investors and businesses in Environmental, Social, and Governance (ESG) criteria comes with significant challenges in assessing third-party partners. According to the DLA Piper report, ESG evaluation of external providers has become critical, particularly with the CS3D directive (Corporate Sustainability Due Diligence) coming into force on July 25, 2024. This directive requires […]

23 April 2025ESG Platforms: Centralized Data for Sustainable PerformanceSolutionsThe growing interest of investors and businesses in Environmental, Social, and Governance (ESG) criteria comes with significant challenges in assessing third-party partners. According to the DLA Piper report, ESG evaluation of external providers has become critical, particularly with the CS3D directive (Corporate Sustainability Due Diligence) coming into force on July 25, 2024. This directive requires […]Read more

-

19 January 2025Aprovall’s Strategic Challenges under CSRDSolutionsFor Aprovall, which supports over 430,000 third-party partners across Europe, operational resilience is a major strategic priority. A recent study reveals that 55% of companies subject to CSRD face difficulties in managing data quality and consistency. In response, Aprovall’s dual ISO 27001/27701 certification provides a robust framework for ESG data governance. In the social housing sector, sustainable performance requires an integrated value chain […]

19 January 2025Aprovall’s Strategic Challenges under CSRDSolutionsFor Aprovall, which supports over 430,000 third-party partners across Europe, operational resilience is a major strategic priority. A recent study reveals that 55% of companies subject to CSRD face difficulties in managing data quality and consistency. In response, Aprovall’s dual ISO 27001/27701 certification provides a robust framework for ESG data governance. In the social housing sector, sustainable performance requires an integrated value chain […]Read more

-

17 February 2025Supplier Due Diligence: A Key Pillar in Risk ManagementSolutionsSupplier due diligence has become a critical component of third-party governance in a context where nearly 50% of mergers fail due to inadequate partner assessment. This structured approach to collaborative evaluation enables organizations to build operational resilience while ensuring regulatory compliance. The due diligence process is based on a proven methodology of gathering and analyzing third-party information. It systematically covers six critical […]

17 February 2025Supplier Due Diligence: A Key Pillar in Risk ManagementSolutionsSupplier due diligence has become a critical component of third-party governance in a context where nearly 50% of mergers fail due to inadequate partner assessment. This structured approach to collaborative evaluation enables organizations to build operational resilience while ensuring regulatory compliance. The due diligence process is based on a proven methodology of gathering and analyzing third-party information. It systematically covers six critical […]Read more