How to Assess the Financial Health of Your Third-Party Partners

Assessing the financial health of third-party partners has become a crucial element in ensuring the operational resilience of your supply chain. According to the 2023 report from the Financial Stability Board, economic interdependencies have significantly increased in recent years—bringing flexibility and innovation but also creating potential risks for financial stability if not properly managed.

Understanding how to effectively assess these partners can help you anticipate unexpected disruptions and implement appropriate third-party governance. In this article, we explore preventive assessment methods, early warning signs to watch for, and best practices for conducting a sector-relevant risk analysis.

Which Financial Indicators Should You Monitor?

Assessing the financial health of suppliers requires close monitoring of several key indicators.

According to Altares D&B, 2024 saw a record number of business failures in France. Although the overall increase in insolvencies slowed (+17% in 2024 vs. +36% in 2023), large enterprises remain vulnerable (+30% for companies with over 50 employees), particularly in high-risk sectors such as manufacturing, wholesale, and transportation—putting over 256,000 jobs at risk.

The liquidity ratio is especially revealing, as it measures a company’s ability to meet its short-term obligations. A ratio above 1 generally indicates a healthy financial situation, while a lower value may signal potential cash flow difficulties.

How to Interpret Financial Data

Effective interpretation of financial data relies on contextual analysis adapted to each sector:

- Time Trends: Analyze indicators across multiple periods to identify meaningful patterns.

- Sector Comparisons: According to the Banque de France, payment terms vary widely by company size—50% of large firms exceed the legal 60-day limit, compared to only 20% of microenterprises.

- Sector-Specific Vulnerability Indexes: In the industrial sector, a sudden drop in investments for ICPE (classified installations for environmental protection) maintenance may signal financial stress even before traditional ratios deteriorate.

- Payment Behavior (Paydex): Tools like Altares D&B’s Paydex track late payments and offer early warnings to contracting organizations.

In the public sector, financial data analysis as part of third-party governance must consider the specific nature of public budget cycles and regulatory constraints tied to public procurement.

Why Preventive Evaluation Is Crucial

Preventive evaluation of external providers is a cornerstone of operational resilience. According to a 2025 Panorays study, nearly 48% of organizations lack a complete inventory of the third parties they work with—contributing to the alarming fact that 98% of companies are connected to at least one external partner who has experienced a data breach.

In the public sector, local governments significantly reduce non-compliance risks in public procurement when they implement structured management of third-party relationships through systematic evaluation and partner management.

Anticipating failures not only helps maintain business continuity but also strengthens your position in contractual negotiations. In the public sector, this proactive approach is particularly relevant given tight budgets and complex approval cycles.

What Are the Key Steps of an Effective Risk Analysis?

To implement a structured risk analysis, follow these essential steps:

- Identification and Categorization: Create a comprehensive inventory of your strategic suppliers and categorize them based on their criticality to your operations.

- In-Depth Evaluation: Conduct tailored due diligence according to the risk level, including operational controls and regulatory compliance.

- Continuous Monitoring: Implement real-time monitoring tools to regularly reassess risk.

In the manufacturing industry, especially at ICPE sites, this method allows early identification of suppliers that could jeopardize environmental compliance. Incorporating collaborative evaluation into personalized smart workflows significantly increases the effectiveness of this approach—provided that information sharing between buyers and suppliers is transparent.

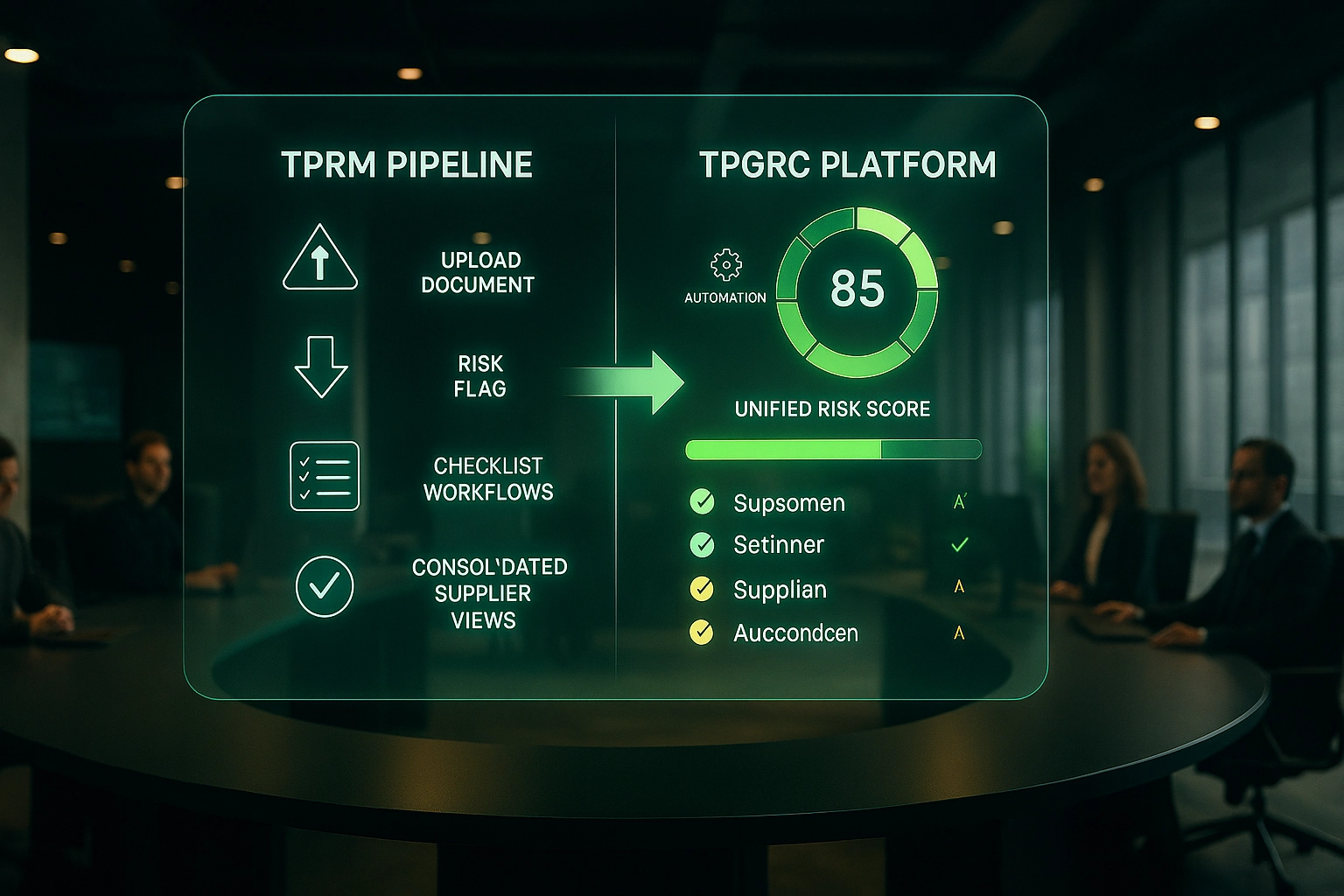

Discover how to automate your third-party evaluations

Streamline your assessment processes and save valuable time collecting supplier documentation with solutions tailored to your sector.

Which Red Flags Should You Watch For?

Identifying warning signs is essential to anticipate potential supplier failures. According to a 2025 study by Delta Assurances, payment delays are the most revealing indicator of deteriorating financial health—especially when they become frequent or when explanations are vague.

Here are four key risk indicators to monitor:

- Changes in Auditor Opinions: Any change in audit reports—such as added disclaimers—can signal disagreements over financial statements.

- Declining Profitability: A consistent drop in gross margins or irregular profits often indicates structural issues.

- Commercial Behavior Changes: Sudden discount requests, extended payment terms, or deteriorating communication are serious concerns.

- Rising Accounts Receivable: In the construction sector, this may indicate difficulties in collecting payments from clients—triggering a domino effect across the subcontracting chain.

Altares D&B’s Perspective

Risk evaluation in a tense economic environment requires solid expertise and objective analysis. Overreacting to negative signals, even out of caution, can destabilize your operations and worsen current challenges.

Thanks to high-quality data, advanced AI tools, and a leading team of data scientists, Altares D&B’s failure score offers unmatched predictive performance.

Gilles Lambert – Product Marketing Manager, Finance Solutions | Altares D&B

Economic Dependence and Fragile Ties

Assessing a supplier’s financial health must include evaluating their level of economic dependence, which is key to understanding long-term stability. According to the DGCCRF, economic dependence occurs when “a company has no technically and economically equivalent alternative to its current contractual relationship with another firm.”

A supplier that derives more than 50% of its revenue from a single client presents a high-risk profile and requires in-depth evaluation, as emphasized by Capeb.

To assess this risk, analyze customer diversification among your strategic suppliers. In industry, particularly for ICPE sites, a supplier with high economic dependence may lack the resources to invest in environmental compliance and preventive maintenance.

In the distribution sector, collaborative evaluation of economic dependence is part of a mature third-party governance approach—helping identify suppliers in need of tailored support plans. According to Gesica, “establishing a dedicated process and constantly monitoring economically dependent suppliers is a best practice for maintaining fair and lasting commercial relationships.”

How to Integrate Financial Compliance into Your Evaluation Process

Integrating financial compliance into your third-party evaluation process is a core pillar of third-party governance.

The collaborative evaluation of financial compliance transforms a traditionally one-sided process into a co-constructed initiative. In the distribution sector, this allows stakeholders to mutualize document checks, reducing supplier fatigue while improving data quality. The DGCCRF—which ensures fairness in business relations—stresses the importance of transparency between commercial partners to guarantee sustainable, balanced exchanges.

For local governments, this collaborative approach is especially relevant in public procurement, where verifying a bidder’s financial stability is a regulatory requirement.

Why Constructive Relationships Matter

Building constructive relationships with third-party contacts goes far beyond merely assessing their financial health. In the construction industry, “strong interpersonal skills and smooth communication with project owners are often key to success, as clients usually prefer to work with a single trusted point of contact.”

This collaborative mindset offers several benefits:

- Reduces supplier fatigue through transparent, shared assessments

- Enables early identification of financial issues via regular communication

- Builds trust and strengthens operational resilience through effective partner oversight

In industry—especially at ICPE-regulated sites—this collaboration helps ensure continuity of operations while meeting environmental compliance obligations. In this way, collaborative evaluation becomes a shared performance driver, not just a control tool.

Turning Supplier Financial Evaluation into a Strategic Advantage

Evaluating your suppliers’ financial health has become a vital part of modern operational resilience.

To turn this evaluation into a true strategic advantage, you need a structured approach that includes:

- Rigorous analysis of sector-specific financial indicators

- Preventive assessment supported by automated workflows

- Ongoing vigilance for specific warning signs

- Mastery of third-party risk that fully incorporates financial compliance

- Constructive relationships that foster transparency and collaboration

Setting up a continuous monitoring system, as recommended by experts, allows early risk detection and proactive intervention—turning financial evaluation from a mere formality into a real performance and sustainability lever for your organization.

Turn your third-party evaluation process into a competitive edge

Strengthen your operational resilience and optimize partner management with a comprehensive third-party assessment platform.

These articles might interest you

-

13 April 2025Automated Financial Scoring: Optimizing Third-Party AssessmentSolutionsIn today’s world of interconnected supply chains, businesses can no longer afford to manage their supplier relationships blindly. A partner’s financial health can quickly become a critical risk factor. This is precisely the view of procurement leaders, who rank the risk of third-party financial failure as their number one concern, according to the AgileBuyer study. […]

13 April 2025Automated Financial Scoring: Optimizing Third-Party AssessmentSolutionsIn today’s world of interconnected supply chains, businesses can no longer afford to manage their supplier relationships blindly. A partner’s financial health can quickly become a critical risk factor. This is precisely the view of procurement leaders, who rank the risk of third-party financial failure as their number one concern, according to the AgileBuyer study. […]Read more

-

18 July 2025Why Connecting Your Risk Mapping to TPRM Is a Game ChangerSolutionsIn a context where third-party ecosystems are expanding, organizations can no longer afford to manage their vendor relationships blindly. Companies are now selecting partners based on increasingly specific criteria, and many have implemented risk mapping tools to gain a clearer view of the risks posed by their subcontractors. They must actively manage third-party risks. According […]

18 July 2025Why Connecting Your Risk Mapping to TPRM Is a Game ChangerSolutionsIn a context where third-party ecosystems are expanding, organizations can no longer afford to manage their vendor relationships blindly. Companies are now selecting partners based on increasingly specific criteria, and many have implemented risk mapping tools to gain a clearer view of the risks posed by their subcontractors. They must actively manage third-party risks. According […]Read more

-

20 January 2025The Stakes of TPRM and TPGRC in 2025: A Complete Guide for Modern EnterprisesSolutionsIn a constantly evolving regulatory environment, organizations face unprecedented challenges in third-party governance. In 2025, 57% of companies identify operational disruption as their main third-party risk, while 64% now assess their suppliers’ suppliers as part of their risk management strategy, according to the EY 2025 Global Third-Party Risk Management Survey. This growing complexity requires a […]

20 January 2025The Stakes of TPRM and TPGRC in 2025: A Complete Guide for Modern EnterprisesSolutionsIn a constantly evolving regulatory environment, organizations face unprecedented challenges in third-party governance. In 2025, 57% of companies identify operational disruption as their main third-party risk, while 64% now assess their suppliers’ suppliers as part of their risk management strategy, according to the EY 2025 Global Third-Party Risk Management Survey. This growing complexity requires a […]Read more

-

17 December 2025How TPRM Maximizes the Management of Class C SuppliersSolutionsThe Class C Supplier Paradox In most organizations, the management of Class C suppliers is built on a well-known paradox: they represent only about 20% of total procurement spend, but consume nearly 80% of the procurement team’s time. These suppliers, often non-strategic and outside of core production, generate a high volume of invoices, administrative tasks, […]

17 December 2025How TPRM Maximizes the Management of Class C SuppliersSolutionsThe Class C Supplier Paradox In most organizations, the management of Class C suppliers is built on a well-known paradox: they represent only about 20% of total procurement spend, but consume nearly 80% of the procurement team’s time. These suppliers, often non-strategic and outside of core production, generate a high volume of invoices, administrative tasks, […]Read more