The Stakes of TPRM and TPGRC in 2025: A Complete Guide for Modern Enterprises

In a constantly evolving regulatory environment, organizations face unprecedented challenges in third-party governance. In 2025, 57% of companies identify operational disruption as their main third-party risk, while 64% now assess their suppliers’ suppliers as part of their risk management strategy, according to the EY 2025 Global Third-Party Risk Management Survey. This growing complexity requires a more sophisticated approach than traditional risk management alone.

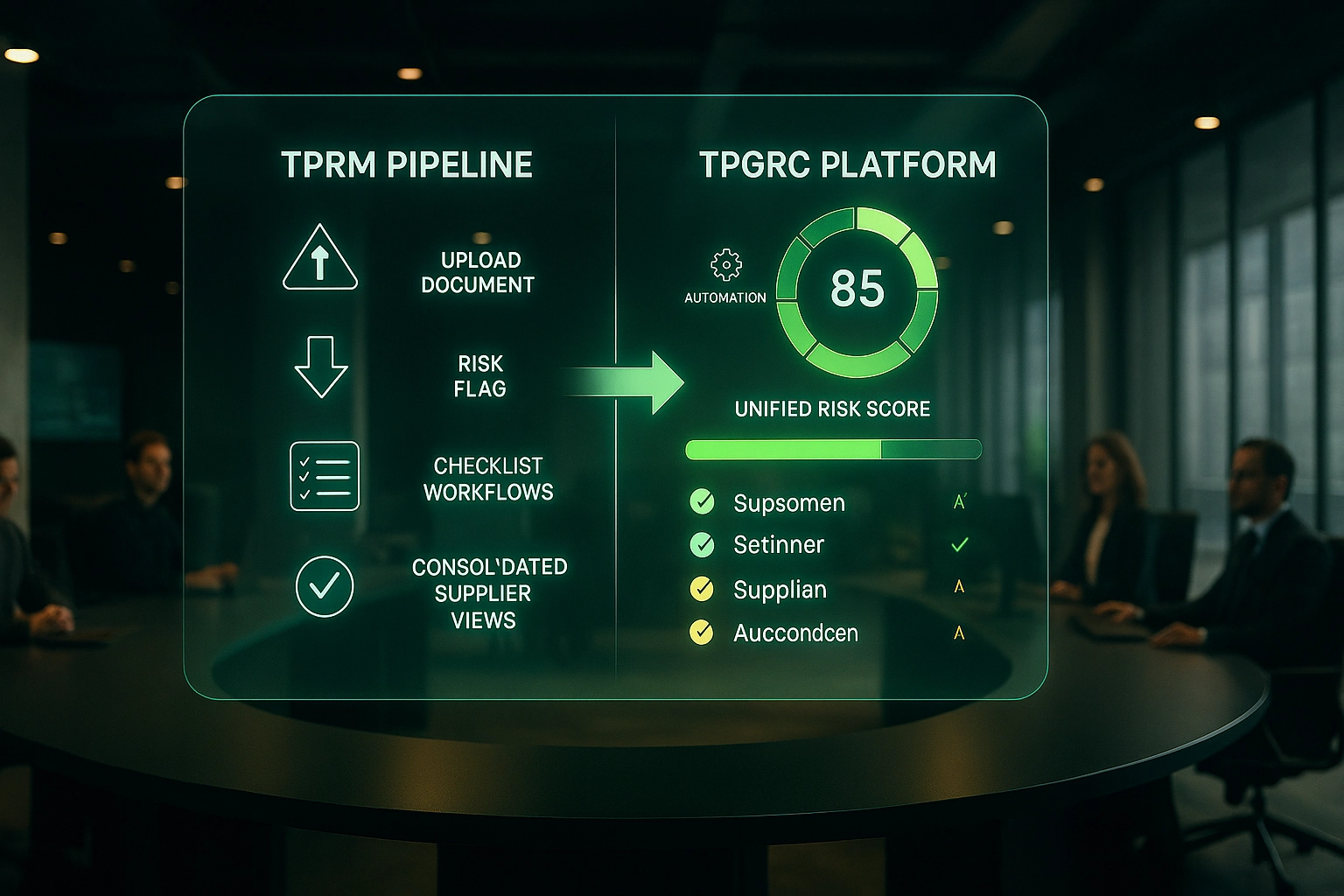

Third-Party Governance & Risk Compliance (TPGRC) represents the natural evolution of Third-Party Risk Management (TPRM), offering a more global and integrated vision of third-party risks. This unified approach is becoming essential as new regulations such as DORA (effective since January 2025), CSRD, and NIS2 profoundly reshape compliance and operational resilience requirements.

This guide outlines the 5 key steps to structure your migration toward an effective TPGRC solution, adapted to the specific challenges of your industry. Whether you operate in the public sector, industry, construction, or retail, each step can be customized to address your particular third-party governance challenges.

Why Moving from TPRM to TPGRC Is Now Essential

Definitions and Key Differences Between TPRM and TPGRC

Third-Party Risk Management (TPRM) is a methodological approach designed to evaluate and manage risks linked to external partners. While effective at identifying punctual vulnerabilities, it primarily focuses on risk analysis without necessarily embedding them into a broader strategic framework. See our article on the fundamentals of TPRM.

Third-Party Governance & Risk Compliance (TPGRC) is the natural evolution of TPRM, providing a more holistic and integrated approach. While TPRM focuses on risk identification, TPGRC covers the entire lifecycle of third-party relationships—from initial selection to continuous monitoring, collaborative assessment, and shared governance.

The 5 Key Steps for Effective Third-Party Risk Governance

A successful migration toward TPGRC revolves around five fundamental steps that turn simple compliance documentation into a true strategic lever for the organization:

- Automate regulatory document collection, the foundation of any third-party governance framework. Automation significantly reduces manual errors while ensuring the continuous compliance of critical documents.

- Centralize documentation to unify internal and external information in a single secure repository. This eliminates data silos and ensures reliable, up-to-date access for all stakeholders.

- Implement intelligent workflows to orchestrate approval and validation processes. Automation reduces processing times while strengthening traceability, a critical element given that 87% of organizations experienced a third-party incident in the past three years (source: Deloitte study).

- Deploy systematic third-party risk assessments using targeted questionnaires, clear performance indicators, and required document collection. This methodology quickly identifies critical partners and anticipates potential vulnerabilities.

- Unify governance within an integrated platform that provides a consolidated view of risks and performance. This holistic approach streamlines strategic decision-making and strengthens operational resilience.

Ready to upgrade your third-party risk management approach?

Discover how Aprovall360 unifies governance, risk management, and partner compliance into a single collaborative platform.

Regulatory Collection: The Foundation of Any TPRM Strategy

Automation for Continuous Compliance

Automated collection of regulatory documents is the backbone of any TPGRC solution.

The first step in migrating toward TPGRC is to establish an automated process for gathering regulatory documents. These often include certifications, licenses, tax and social attestations, and sector-specific declarations (such as energy, environment, or health).

Automation enables:

- Ensuring continuous compliance: Real-time monitoring ensures documents are renewed automatically before expiry.

- Reducing manual errors: Eliminates manual entry, lowering risks of mistakes and non-compliance.

- Improving efficiency: Documents are collected directly from suppliers and partners while being verified.

With automation, you establish the foundation of rigorous and proactive document governance. This first brick reduces administrative burden while increasing data reliability.

Sector Use Cases: Document Collection in Public Sector and Industry

Logistics providers: A transport company working with subcontractors uses TPGRC to automatically collect and validate regulatory documents (civil liability insurance, URSSAF) before awarding contracts. Automatic reminders ensure timely renewal.

Public procurement: Local authorities must ensure that bidding companies comply with legal requirements (URSSAF, tax certificates, liability insurance). An automated platform collects, verifies, and follows up on missing or expired documents.

Industrial compliance: Manufacturers must ensure suppliers hold ISO certifications (9001, 14001). Automation collects, archives, and updates documents seamlessly, reducing delays and compliance risks.

Document Compliance: Beyond Simple Risk Management

Centralization of Internal and External Documents for Unified Governance

Document management ensures that both regulatory and internal documents are complete, validated, and always up to date.

Document compliance goes beyond external requirements. It is equally essential to collect, organize, and validate internal documents such as security policies, business continuity plans (BCPs), or supplier contracts.

A TPGRC solution centralizes these documents in a single, secure repository, enabling:

- Quick access to information: All documents are accessible in just a few clicks, saving time and avoiding lengthy searches.

- Version control: The platform ensures documents are always up to date, with obsolete versions archived.

- Compliance with industry standards: Whether ISO 9001, GDPR, or other sector-specific requirements, the solution guarantees your documents meet expected standards.

By structuring document management in this way, you limit risks linked to incomplete or invalid documents while optimizing internal processes.

Practical Applications of Document Compliance by Industry Sector

Managing Grant-Related Documents

A regional authority managing European funds must ensure that beneficiary associations provide compliant supporting documents (financial reports, contracts, activity reports). Centralizing these documents within a TPGRC solution simplifies tracking of supporting evidence while ensuring compliance with European Commission guidelines.

Supplier Contract Tracking in Retail

A supermarket chain must collect supplier contracts and general terms of sale. The solution centralizes these documents, automatically checks their validity, and generates renewal alerts to avoid supply interruptions.

Centralization of Supplier Technical Sheets in Agri-Food

A food industry manufacturer centralizes supplier technical sheets (ingredients, allergens, organic certifications). The TPGRC platform provides real-time access to these documents, ensuring final product compliance and enabling rapid responses to quality inspections.

Document Processes and Workflows: The Intelligent Orchestration of TPGRC

Automation of flows for continuous third-party monitoring

Workflow automation enables smooth and transparent management of document processes. Setting up processes and workflows is a key step to make your operations more efficient and transparent. The TPGRC solution integrates customizable workflows to automate tasks such as:

- Document validation by managers

- Automatic reminders to third parties for collecting or updating information

- Tracking critical deadlines with real-time alerts

How intelligent workflows transform third-party risk management

- Time savings: Repetitive tasks are automated, freeing up teams for higher-value activities

- Full traceability: Every step is recorded, providing a clear view of all actions taken

- Improved collaboration: Internal teams and external partners collaborate on a shared platform, facilitating communication and data exchange

By automating document workflows, you gain operational efficiency while ensuring rigorous tracking of all actions performed.

Concrete examples of process optimization in different sectors

Validation of supporting documents for social assistance

A public administration processing social aid applications uses workflows to automate the collection, verification, and validation of documents (proof of residence, income declarations). Automatic reminders and notifications ensure rapid processing of applications, reducing delays for beneficiaries.

Validation of compliance audits in a pharmaceutical company

A pharmaceutical company must validate audit documents (GMP standards) for its subcontractors. The automated workflow allows quality managers to validate steps, identify non-compliances, and document corrective actions while ensuring complete traceability of exchanges.

Validation of supplier tenders in construction

A construction company uses workflows to manage the steps of a tender: collecting documents, analyzing applications, validation by technical and financial managers. Thanks to automatic notifications, all stakeholders are informed in real time of the project’s progress, speeding up the selection process.

Assessment and management of third-party risks

Third-party risk management is a fundamental step in ensuring the reliability of your partners, suppliers, and subcontractors. The TPRM module of the TPGRC solution makes it possible to assess:

- Third-party maturity: What are their compliance levels and their ability to meet requirements?

- Their commitment to critical areas: This includes financial health (solvency), regulatory compliance, and cybersecurity.

Integrated tools for comprehensive assessment

- Automated assessment questionnaires: Collect essential information directly from third parties

- Performance indicators: The solution provides risk scores to quickly identify critical partners

- Continuous monitoring: With real-time updates, you can detect potential weaknesses and address them before they become problematic

With TPRM, you strengthen your resilience to external risks and ensure a rigorous selection of your partners.

Third Party Risk Management (TPRM) : les fondamentaux à maîtriser

Méthodologie d’évaluation et de gestion des risques liés aux tiers

Le Third Party Risk Management (TPRM) constitue une approche structurée permettant d’identifier, d’évaluer et de gérer les risques associés aux partenaires externes. Dans un environnement où 57% des organisations ont subi un incident impliquant un tiers au cours des trois dernières années selon une étude de SecurityScorecard, la mise en place d’une méthodologie robuste devient indispensable.

Cette approche méthodologique s’articule autour de trois axes fondamentaux : l’évaluation de la maturité des tiers face aux exigences réglementaires, l’analyse de leur engagement sur des thématiques critiques (cybersécurité, conformité, finance), et le monitoring continu de leur performance. Contrairement à la gestion traditionnelle des risques qui se concentre sur les vulnérabilités internes, le TPRM étend cette vigilance à l’ensemble de l’écosystème de partenaires.

Avec l’entrée en vigueur de réglementations comme DORA et NIS2 qui imposent désormais une surveillance accrue des prestataires de services, particulièrement dans les secteurs financiers et les infrastructures critiques, le TPRM devient un pilier essentiel de toute stratégie de gouvernance.

Outils et solutions pour une évaluation complète des partenaires externes

La mise en œuvre efficace d’une stratégie TPRM repose sur des outils d’évaluation automatisés qui transforment la collecte d’informations en insights actionnables. Ces solutions intègrent :

- Des questionnaires d’évaluation ciblés qui permettent de collecter des données pertinentes directement auprès des tiers, réduisant ainsi la charge administrative tout en garantissant la qualité des informations.

- Des indicateurs de performance clairs qui traduisent les réponses en scores de risque, facilitant l’identification rapide des partenaires critiques nécessitant une attention particulière.

- Des systèmes d’alerte en temps réel qui détectent automatiquement les changements de statut, les non-conformités émergentes ou les vulnérabilités potentielles avant qu’elles n’impactent vos opérations.

- Des tableaux de bord analytiques offrant une vision consolidée des risques par catégorie, par secteur ou par niveau de criticité, permettant ainsi des prises de décision éclairées.

Ces outils transforment la gestion des risques tiers d’une approche réactive à une démarche proactive et stratégique, alignée avec les objectifs business de l’organisation.

Études de cas : le TPRM appliqué aux secteurs public, BTP et distribution

Secteur public : Évaluation des risques pour les délégations de service public

Une métropole confiant la gestion de son réseau de transport à un prestataire privé doit évaluer rigoureusement les risques financiers, opérationnels et environnementaux du délégataire. La solution TPRM permet d’analyser les données du tiers, d’identifier les points de vigilance (solvabilité, conformité aux normes ISO) et d’assurer un monitoring continu tout au long du contrat, garantissant ainsi la continuité du service public.

BTP : Gestion des sous-traitants multi-niveaux

Un groupe de construction gérant des projets d’envergure doit s’assurer de la conformité de ses sous-traitants et de leurs propres sous-traitants. Le TPRM permet d’établir une cartographie complète des intervenants, d’évaluer leurs risques spécifiques (travail détaché, certifications techniques) et de mettre en place des plans de remédiation ciblés, réduisant ainsi les risques de non-conformité sur les chantiers.

Une banque travaillant avec plusieurs fournisseurs technologiques doit s’assurer de leur conformité en matière de cybersécurité. Le TPRM permet de :

- Distribuer des questionnaires d’évaluation.

- Obtenir des scores de risque basés sur des critères comme la certification ISO 27001.

- Surveiller les vulnérabilités pour prévenir les cyberattaques potentielles.

Distribution : Évaluation des fournisseurs internationaux

Une enseigne de distribution travaillant avec des fournisseurs mondiaux utilise le TPRM pour évaluer les risques liés à sa chaîne d’approvisionnement internationale. La solution attribue des scores de risque basés sur des critères ESG, de conformité produits et de résilience logistique, permettant d’anticiper les ruptures potentielles et de sécuriser les approvisionnements stratégiques.

Third Party Governance & Risk Compliance (TPGRC): The Strategic Evolution

The TPGRC Platform: A Global and Integrated Vision of Third-Party Risks

TPGRC (Third Party Governance & Risk Compliance) represents the natural evolution of traditional third-party risk management approaches. Unlike TPRM, which focuses primarily on assessing individual risks, TPGRC provides a unified platform to orchestrate all interactions with third parties through a comprehensive governance vision.

This integrated approach is becoming particularly critical in 2025, as organizations face an increasingly complex regulatory landscape. According to the report “Governance, Resilience and Compliance, 2025: Market Update” published on May 12, 2025, companies must now evaluate risks not in isolation but across their entire ecosystem, taking into account potential cascading effects.

A robust TPGRC platform centralizes all third-party related data—assessments, documents, certifications, incidents—within a single, secure repository. This centralization enables the creation of dynamic and innovative dashboards that provide real-time visibility into each partner’s compliance status and risk levels.

Measurable Benefits of a TPGRC Approach for Your Organization

Adopting a TPGRC approach generates tangible benefits for organizations that implement it:

- Significant reduction of risk exposure through early identification of vulnerabilities and the implementation of targeted remediation plans.

- Reputation protection by improving control over regulatory and ethical risks associated with third parties, in a context where incidents involving external partners are increasingly scrutinized by the media.

- Elimination of information silos by integrating and sharing data across all relevant teams (finance, compliance, procurement, legal), fostering a unified risk vision and stronger collaboration.

- Strengthening of operational resilience through robust governance processes that enable organizations to anticipate and effectively manage potential supply chain disruptions.

- Optimization of decision-making processes thanks to real-time alerts and analytical dashboards that make it easier to identify areas for improvement and prioritize corrective actions.

According to a recent study by Cyber Defense Magazine published on April 19, 2025, organizations that adopted an integrated TPGRC approach reported a 60% reduction in third-party related incidents compared to those relying solely on periodic assessments.

Reducing “Supplier Fatigue” Through the Pooled TPGRC Approach

“Supplier fatigue” is a major challenge for organizations seeking to evaluate their partners. This phenomenon occurs when suppliers are overwhelmed by multiple and redundant requests for information from different clients.

One of the main sources of this fatigue is the proliferation of questionnaires: a single supplier may receive dozens of requests each month, covering various regulations as well as distinct ESG assessments on human rights, conflict minerals, or environmental performance.

The pooled TPGRC approach helps solve this issue by:

- Centralizing evaluations to avoid duplication and reduce the administrative burden on suppliers.

- Standardizing questionnaires to collect only relevant and necessary information.

- Sharing assessment results across the company’s different functions, preventing suppliers from being asked multiple times for similar information.

- Enabling organizations to identify third parties who have already completed assessment journeys, thus avoiding unnecessary follow-ups.

This collaborative approach significantly improves the supplier experience while enhancing the quality and reliability of collected data, creating a virtuous cycle that benefits the entire ecosystem.

Sector Applications: TPGRC in Action Across Your Industry

Public Sector: Integrated Governance of Critical Service Providers

A French metropolitan area centralizes risk management related to its service providers for energy renovation projects. The TPGRC platform enables simultaneous monitoring of financial, environmental (compliance with RE2020 standards), and social risks. Teams access a unified dashboard that facilitates strategic decision-making and optimized budget allocation. This integrated approach reduced the time spent on partner evaluation by 40% while strengthening compliance with NIS 2 requirements for critical infrastructure.

Automotive Industry: Supply Chain Resilience

An automotive manufacturer managing hundreds of international suppliers must monitor environmental compliance (ESG criteria) and the quality performance of its partners. The TPGRC platform centralizes this data, identifies critical risks in real time, and provides recommendations to improve supply chain resilience. This consolidated view helps anticipate potential disruptions and implement proactive mitigation strategies, significantly reducing the impact of disruptions on production.

Distribution & Retail: Optimized Supplier Performance

A global retail chain uses TPGRC to centralize information on supplier performance and compliance across different regions of the world. This pooled approach significantly reduces supplier fatigue by harmonizing assessment questionnaires and sharing results among subsidiaries. Procurement, quality, and compliance teams now collaborate on a single platform, improving decision-making consistency and strengthening the company’s position against cross-border regulatory risks.

They Transformed Their Third-Party Governance with Aprovall

Discover how organizations in your industry have strengthened their operational resilience and optimized compliance with our TPGRC solutions.

How to Implement a TPGRC Solution Adapted to Your Industry

Assessing Your Current Third-Party Governance Maturity

Implementing an effective TPGRC solution begins with an objective assessment of your current third-party governance maturity. This diagnostic step is essential to identify strengths to build upon and gaps to address.

To effectively evaluate your current maturity in third-party governance, it is crucial to analyze your existing third-party management processes: document collection, risk assessment, and continuous monitoring. Experience shows that organizations generally fall into one of four maturity levels in their governance approach:

- Reactive level: characterized by case-by-case management without formalized processes

- Structured level: processes are defined but remain siloed across departments

- Integrated level: a coordinated approach is implemented across different functions

- Optimized level: proactive and collaborative governance integrated into the overall strategy

This classification makes it possible to pinpoint your current position and define a personalized roadmap that leverages your existing strengths while targeting priority areas for improvement in your transition to TPGRC.

This assessment should also take into account industry-specific requirements that influence your third-party governance approach. For example, public sector organizations must pay particular attention to transparency requirements and tender procedures, while retail players will focus more on product compliance and supply chain resilience.

Roadmap for a Successful Transition from TPRM to TPGRC

The migration from a traditional TPRM approach to integrated TPGRC governance requires strategic planning and a gradual implementation. Here are the key steps to structure this transition:

- Define a clear vision and measurable objectives for your TPGRC program, aligning the expectations of different stakeholders (executives, operational teams, compliance, procurement). This vision should reflect your organization’s strategic priorities while incorporating the regulatory requirements specific to your sector.

- Map your third-party ecosystem by identifying critical partners according to risk criteria relevant to your business. This mapping should consider the potential impact of each third party on your operations, regulatory compliance, and reputation.

- Select a suitable technology platform that provides the essential features for your industry and integrates with your information system. For the public sector, prioritize solutions that incorporate public procurement requirements; for industry, look for advanced supply chain monitoring capabilities.

- Train teams and develop the necessary skills for optimal use of the TPGRC solution. Adopting a collaborative approach requires not only technical expertise but also a deep understanding of governance challenges.

- Deploy progressively, starting with a limited scope (e.g., the most critical third parties or a pilot department) before extending the solution to the entire organization. This approach allows for process adjustments and quickly demonstrates the added value of TPGRC.

By following this roadmap tailored to your industry context, you will gradually transform your third-party risk management approach into fully integrated governance, aligned with current regulatory requirements and industry best practices.

Successfully transitioning from TPRM to TPGRC provides not only a technological evolution but also a genuine organizational transformation, placing third-party governance at the heart of your operational resilience strategy.

En opérant une transition réussie du TPRM vers le vers le TPGRC, vous bénéficiez non seulement d’une évolution technologique, mais aussi d’une véritable transformation organisationnelle qui place la gouvernance des tiers au cœur de votre stratégie de résilience opérationnelle.

Assess Your TPGRC Maturity with Our Experts

Benefit from a personalized demonstration of Aprovall360 tailored to the specific needs of your industry, and receive an assessment of your current maturity level in third-party governance.

These articles might interest you

-

25 June 2025Manage Your Supplier Assessments by Context and Project for a 360° ViewSolutionsUnlock the Power of Context-Based Evaluations: Gain Clarity and Impact Supplier assessments are often structured as a top-down relationship: from the client (or buyer) to a panel of suppliers. However, these suppliers frequently operate within shared contexts — whether that’s a product, a contract, or an entire supply chain. Managing third-party evaluations by context gives […]

25 June 2025Manage Your Supplier Assessments by Context and Project for a 360° ViewSolutionsUnlock the Power of Context-Based Evaluations: Gain Clarity and Impact Supplier assessments are often structured as a top-down relationship: from the client (or buyer) to a panel of suppliers. However, these suppliers frequently operate within shared contexts — whether that’s a product, a contract, or an entire supply chain. Managing third-party evaluations by context gives […]Read more

-

06 January 2025TPRM: The Fundamentals and the Shift Toward Integrated GovernanceSolutionsIs your organization ready to handle a major cyberattack targeting one of your critical suppliers? In 2024, the breach at Change Healthcare exposed sensitive medical data of 190 million Americans and paralyzed healthcare systems for weeks—demonstrating just how vulnerable modern supply chains are. This wasn’t an isolated incident: 61% of organizations experienced a third-party data […]

06 January 2025TPRM: The Fundamentals and the Shift Toward Integrated GovernanceSolutionsIs your organization ready to handle a major cyberattack targeting one of your critical suppliers? In 2024, the breach at Change Healthcare exposed sensitive medical data of 190 million Americans and paralyzed healthcare systems for weeks—demonstrating just how vulnerable modern supply chains are. This wasn’t an isolated incident: 61% of organizations experienced a third-party data […]Read more

-

30 January 2025Integrating Information Systems into TPRM PlatformsSolutionsIntegrating information systems into TPRM platforms has become a major strategic issue for organizations. A recent study reveals that 41% of companies experienced a serious third-party breach in the past 12 months, underlining the urgency to adopt robust third-party governance solutions. In this context, Third-Party Risk Management (TPRM)platforms are evolving to offer a more collaborative and […]

30 January 2025Integrating Information Systems into TPRM PlatformsSolutionsIntegrating information systems into TPRM platforms has become a major strategic issue for organizations. A recent study reveals that 41% of companies experienced a serious third-party breach in the past 12 months, underlining the urgency to adopt robust third-party governance solutions. In this context, Third-Party Risk Management (TPRM)platforms are evolving to offer a more collaborative and […]Read more

-

11 March 2025Comprehensive Methodology for Third-Party Risk MappingSolutionsIn today’s business environment, where relationships with external partners are strategic, third-party governance has become an essential priority. Third-party risk mapping is a critical tool for identifying, structuring, and prioritizingfactors that may impact the organization. According to a recent Gartner study, over 60% of organizations have now implemented a centralized or federated model for managing third-party risks, […]

11 March 2025Comprehensive Methodology for Third-Party Risk MappingSolutionsIn today’s business environment, where relationships with external partners are strategic, third-party governance has become an essential priority. Third-party risk mapping is a critical tool for identifying, structuring, and prioritizingfactors that may impact the organization. According to a recent Gartner study, over 60% of organizations have now implemented a centralized or federated model for managing third-party risks, […]Read more