Compare TPRM Platforms in Europe: 7 Key Selection Criteria

Comparing Third-Party Risk Management (TPRM) platforms has become a strategic task for many European organizations. The rise in regulatory requirements, increasing reliance on critical suppliers, and pressure for greater traceability make these decisions more complex than they seem.

Rather than limiting the assessment to a functional comparison, an effective evaluation relies on structural criteria related to governance, compliance, and long-term adoption. Here are seven key criteria to compare TPRM platforms in the European context.

Key Takeaways – Comparing a TPRM Platform in Europe

- A TPRM platform must help demonstrate due diligence, not just collect data.

- European regulations (GDPR, NIS2, DORA, CSRD) increase corporate accountability regarding third parties.

- The value of a TPRM solution lies as much in its organizational adoption as in its functional coverage.

- A relevant comparison is based on trade-offs (depth vs. simplicity, automation vs. governance).

- A TPRM solution should streamline interactions with third parties.

1. Alignment with European Regulatory Frameworks

The first criterion is not technical but regulatory. In Europe, a TPRM platform must operate within an environment shaped by GDPR, NIS2, DORA (for the financial sector), as well as requirements linked to duty of care and CSRD.

Beyond compliance claims, it’s essential to assess whether the platform enables you to:

- Map regulatory requirements to concrete controls;

- Trace evaluations, decisions, and corrective actions;

- Store usable evidence for audits;

- Offer ready-to-use processes aligned with regulations.

An effective platform supports ongoing compliance, not just one-off exercises.

2. Functional Coverage… and the Ability to Stay Proportionate

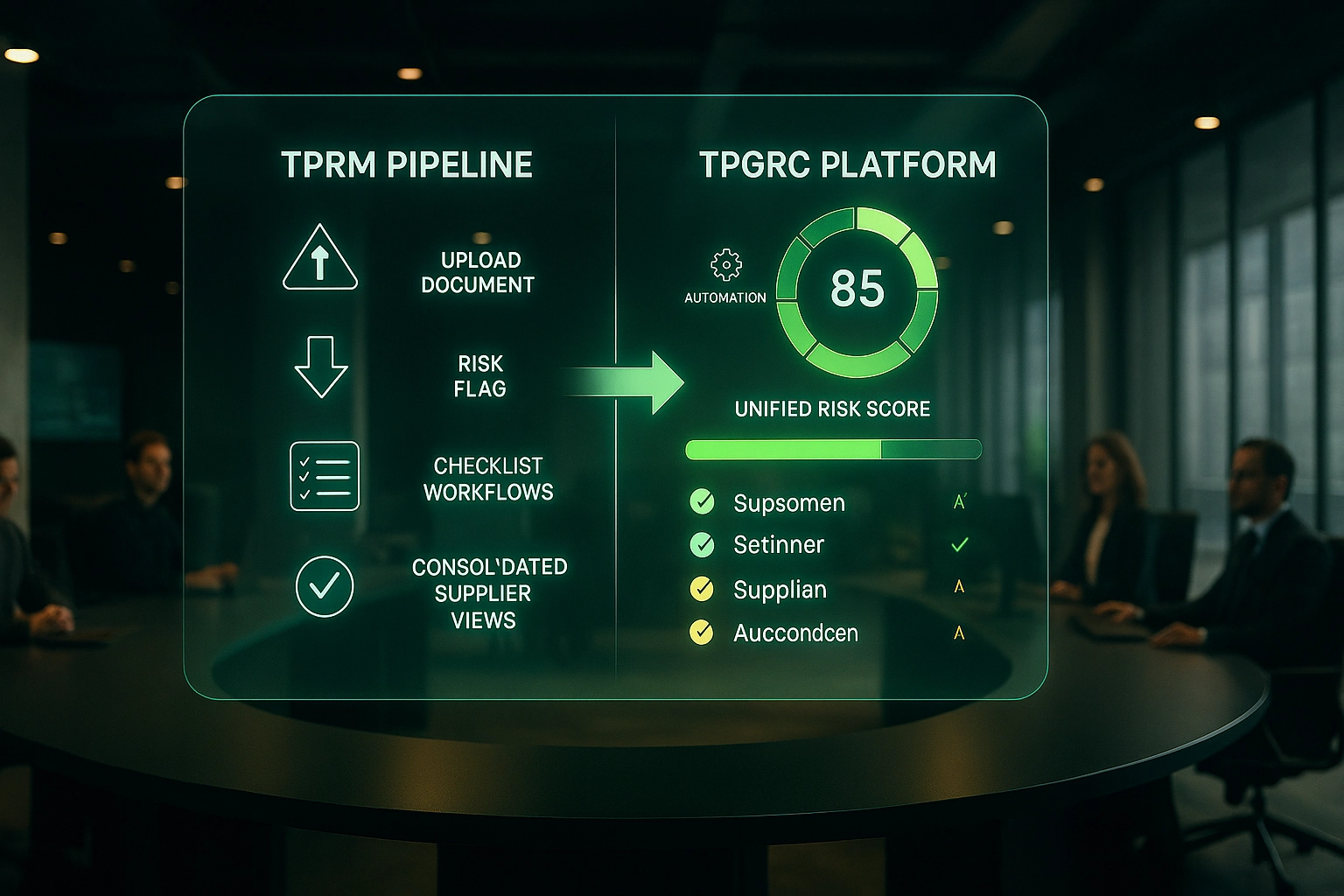

A TPRM platform is more than just a supplier database. It generally includes:

- Risk assessments through questionnaires;

- Document and contract management;

- Remediation plans;

- Ongoing third-party monitoring.

The key point is not the breadth of features, but the ability to adapt control levels based on third-party criticality. A platform that’s too exhaustive may become cumbersome to operate, while insufficient coverage creates blind spots.

Modularity is a central factor in comparison.

3. Integration into the Existing Ecosystem

An isolated TPRM tool quickly creates new silos. A platform must integrate with existing systems, including:

- ERP and procurement tools (SRM),

- GRC or risk management solutions,

- Cybersecurity tools,

- Contract management systems.

This is not just a technical matter. Good integration ensures data quality, reliable evaluations, and the ability to produce a consolidated view of third-party risk.

4. Adoption by Internal Teams & Third Parties

A TPRM platform only creates value if it’s consistently used by:

- Procurement teams,

- Compliance teams,

- IT and Security teams,

- The suppliers themselves.

When comparing platforms, it’s essential to assess:

- User experience and ease of use;

- Training requirements;

- Third-party experience (questionnaires, portals, interactions);

- Cost or free access for third parties (which impacts completion rates).

In Europe’s multilingual context, the ability to adapt to different countries and cultures is a key adoption driver.

5. Data Quality, Reliability & Updates

Third-party risk management relies on often fragmented and self-declared data. A TPRM platform should help:

- Structure information collection;

- Validate data consistency;

- Integrate external signals when relevant.

Update frequency is critical. A static assessment quickly becomes obsolete, especially for critical suppliers or those exposed to cyber, financial, or regulatory risks.

6. Security, Confidentiality & Data Sovereignty

In Europe, data security and privacy are core concerns. A TPRM platform must demonstrate:

- High security standards (encryption, access management, audits);

- Clear GDPR compliance;

- Transparent data hosting and usage policies.

Beyond certifications (e.g., ISO 27001), it’s essential to understand where data is hosted and who can access it—especially in cross-border contexts.

7. Support, Governance & Scalability

A TPRM platform is a long-term investment. The quality of support, team availability, documentation, and change management all strongly influence project success.

Scalability is also key:

- Ability to handle growing volumes of third parties;

- Adaptation to new regulatory requirements;

- Integration of new use cases.

Comparing platforms through this lens helps avoid short-term choices that become roadblocks in the medium term.

Compare Beyond Features

Comparing TPRM platforms in Europe isn’t about listing features. It’s about evaluating how well a solution supports credible, proportionate, and sustainable third-party risk governance.

Using these seven criteria, organizations can structure evaluations that align with their regulatory, operational, and strategic needs—while also ensuring long-term adoption.

For organizations looking to build or evolve their TPRM framework in a European context, Aprovall offers a pragmatic and adaptable approach designed to support every stage of the journey.

Do you have a question?

We have an answer.

No. A TPRM platform structures and prioritizes third-party risk management, but it doesn’t replace human analysis or existing control systems. The goal is to orchestrate evaluations, not eliminate all risk.

The principles are shared, but the level of demand varies by sector. Finance, energy, and public institutions face higher requirements in continuity, cybersecurity, and traceability.

When an organization manages a growing number of critical third parties, operates in a regulated environment, or must demonstrate due diligence, a dedicated platform becomes a key enabler.

By tailoring control levels to third-party criticality and choosing a modular platform. Proportionate governance is often more effective than one-size-fits-all systems.

Focus on the ability to centralize data, enable collaboration, and produce usable evidence—not just the number of standalone features.

Organizations typically monitor evaluation coverage, processing times, incident reduction, and supplier data quality.

These articles might interest you

-

13 April 2025Automated Financial Scoring: Optimizing Third-Party AssessmentSolutionsIn today’s world of interconnected supply chains, businesses can no longer afford to manage their supplier relationships blindly. A partner’s financial health can quickly become a critical risk factor. This is precisely the view of procurement leaders, who rank the risk of third-party financial failure as their number one concern, according to the AgileBuyer study. […]

13 April 2025Automated Financial Scoring: Optimizing Third-Party AssessmentSolutionsIn today’s world of interconnected supply chains, businesses can no longer afford to manage their supplier relationships blindly. A partner’s financial health can quickly become a critical risk factor. This is precisely the view of procurement leaders, who rank the risk of third-party financial failure as their number one concern, according to the AgileBuyer study. […]Read more

-

24 February 2025Third-Party Risk Dashboard: Optimizing Management and MonitoringSolutionsIn a context where supply chains and external partnerships are becoming increasingly complex, third-party governancehas emerged as a strategic priority for companies. According to a recent study, the global third-party risk management market is expected to reach USD 18.7 billion by 2030, driven by growing regulatory demands and increased reliance on external suppliers. A third-party risk dashboard is a central […]

24 February 2025Third-Party Risk Dashboard: Optimizing Management and MonitoringSolutionsIn a context where supply chains and external partnerships are becoming increasingly complex, third-party governancehas emerged as a strategic priority for companies. According to a recent study, the global third-party risk management market is expected to reach USD 18.7 billion by 2030, driven by growing regulatory demands and increased reliance on external suppliers. A third-party risk dashboard is a central […]Read more

-

20 January 2025The Stakes of TPRM and TPGRC in 2025: A Complete Guide for Modern EnterprisesSolutionsIn a constantly evolving regulatory environment, organizations face unprecedented challenges in third-party governance. In 2025, 57% of companies identify operational disruption as their main third-party risk, while 64% now assess their suppliers’ suppliers as part of their risk management strategy, according to the EY 2025 Global Third-Party Risk Management Survey. This growing complexity requires a […]

20 January 2025The Stakes of TPRM and TPGRC in 2025: A Complete Guide for Modern EnterprisesSolutionsIn a constantly evolving regulatory environment, organizations face unprecedented challenges in third-party governance. In 2025, 57% of companies identify operational disruption as their main third-party risk, while 64% now assess their suppliers’ suppliers as part of their risk management strategy, according to the EY 2025 Global Third-Party Risk Management Survey. This growing complexity requires a […]Read more

-

15 December 2025The 5 Risk Levels to Monitor with Temporary Staffing AgenciesSolutionsWhy evaluate temp agencies and temporary workers? Temporary staffing agencies play a key role in your value chain: they provide personnel who are directly involved in your processes—sometimes in sensitive or regulated tasks. By fully integrating them into your TPRM/TPGRC framework, you strengthen operational reliability and reduce long-term risks associated with external collaborators. Temp agencies […]

15 December 2025The 5 Risk Levels to Monitor with Temporary Staffing AgenciesSolutionsWhy evaluate temp agencies and temporary workers? Temporary staffing agencies play a key role in your value chain: they provide personnel who are directly involved in your processes—sometimes in sensitive or regulated tasks. By fully integrating them into your TPRM/TPGRC framework, you strengthen operational reliability and reduce long-term risks associated with external collaborators. Temp agencies […]Read more