ESG Platforms: Centralized Data for Sustainable Performance

The growing interest of investors and businesses in Environmental, Social, and Governance (ESG) criteria comes with significant challenges in assessing third-party partners. According to the DLA Piper report, ESG evaluation of external providers has become critical, particularly with the CS3D directive (Corporate Sustainability Due Diligence) coming into force on July 25, 2024. This directive requires companies to “identify and address adverse human rights and environmental impacts in their operations and across their global value chains.”

As regulatory demands increase, fragmented solutions still widely used today are showing their limits, creating major barriers to coherent and efficient third-party compliance analysis.

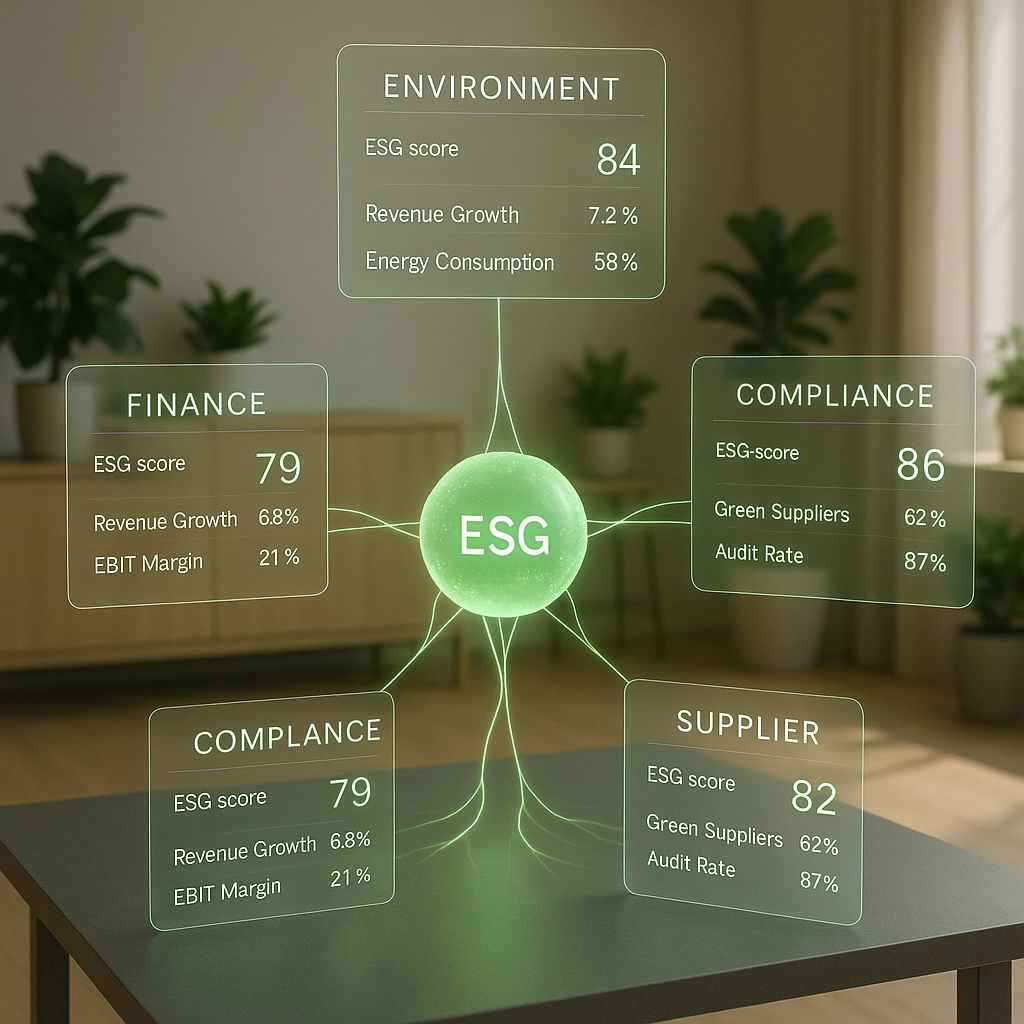

This is where a centralized ESG platform becomes essential, offering significant advantages in regulatory compliance, cooperative third-party verification, and integrated reporting. This approach not only enhances third-party risk management, but also helps build operational resilience in an environment where ESG requirements are rapidly evolving.

Why Choose a Centralized ESG Solution?

In an ever-changing regulatory environment, third-party governance that integrates ESG criteria has become essential. According to a Frontiers in Environmental Science study, companies with strong ESG performance show significant financial improvement over time. Yet isolated methods are no longer sufficient to properly assess third-party compliance.

A centralized ESG platform transforms the evaluation process by creating a single source of truth. In the construction industry, this consolidation makes it easier to manage multi-tier subcontractors, as illustrated by the OPPBTP and Umgo-FFB partnership on occupational risk prevention.

How Does a Centralized Platform Improve Efficiency?

Centralizing ESG data significantly improves shared third-party analysis. A certified EUCS platform ensures both compliance with standards and European data sovereignty — a critical issue for the public sector.

This approach greatly reduces “supplier fatigue” thanks to a shared “pay-to-collect” model, where organizations share the cost of evaluation while benefiting from a collective knowledge base. The mutualization of data and automation of documentation workflows creates a virtuous cycle where every assessment enhances the entire ecosystem. According to ESG News, in the retail sector, this approach helps resolve supply chain sustainability and manufacturing inefficiencies, strengthening process robustness across the ecosystem.

The Benefits of Integrated Solutions for Sustainable Performance

Adopting an integrated solution for external stakeholder assessment radically changes third-party relationship management. According to Payhawk, companies that implement effective ESG strategies benefit from three main advantages: better supply chain management, deeper supplier insight, and significantly reduced carbon footprint. This allows for ESG data to be efficiently integrated into other strategic functions, creating essential organizational synergy.

A unified ESG system ensures all environmental, social, or governance aspects are analyzed through a strategic, coherent lens. In the industrial sector, this enables optimization of REACH compliance (Registration, Evaluation, Authorisation and Restriction of Chemicals) and boosts supply chain resilience. Mutualized evaluations reduce supplier fatigue while improving data quality.

Successful Use Cases of ESG Platforms

Success stories are emerging across various sectors. In the public domain, the city of Vienna launched a collaborative platform where citizens proposed climate projects, resulting in the implementation of 19 concrete initiatives. This participatory approach strengthens community engagement while optimizing third-party risk management.

In construction, ESG data integration has transformed industry practices. The sector accounts for 21% of global greenhouse gas emissions, according to the UN. According to WeCount, centralized ESG integration facilitates collective decarbonization actions, including recycling and reuse of materials.

Third-Party Risk Management: A Necessity for Sustainability

Third-party governance has become a core pillar of any effective ESG strategy. With increasingly complex supply chains, shared evaluation of external partners is essential to ensure operational continuity. A structured approach helps identify partners requiring in-depth evaluation and validate mitigation effectiveness.

In industry, this is particularly relevant due to ICPE regulations. Service mutualization among industrial players supports the sector’s ecological transition, aligned with France’s National Low-Carbon Strategy. A centralized ESG platform enables constant monitoring of potential risks, ensuring regulatory alignment and continuous operations in a shifting environmental landscape.

Advanced Data Collection and Analysis: The Future of ESG

Centralized ESG data is transforming third-party evaluation. According to ESG Matrix, AI-powered ESG reporting will revolutionize data collection, analysis, and governance. This not only facilitates compliance but also enables predictive risk analysis.

In industry, advanced analysis helps improve ICPE compliance while proactively identifying environmental risks across the supply chain. Workflow automation and real-time monitoring turn third-party management into a dynamic, continuous process — not a one-time audit.

Toward an Integrated Culture of Sustainability

Integrating ESG into third-party evaluation requires a deep cultural shift. A study by The Collective shows this involves clear communication across all organizational levels, making sustainability a core value rather than just a set of policies.

In the public sector, a paper from the East Asian Journal of Business Economics found that public institutions integrating ESG in third-party relations significantly strengthen social trust. Creating a consolidated ESG environment provides every department with the information needed to align with the organization’s broader vision.

The Growing Importance of Integrated ESG Reporting

Integrated ESG reporting is now fundamental for transparency — especially in third-party assessment. According to the OECD, 31% of companies (representing 66% of global market cap) have already secured external verification for their ESG reports. This trend is accelerating with the new CSRD directive, which mandates ESG reporting in the first half of 2025.

Consolidating ESG data ensures consistent, reliable reporting, helping meet legal requirements and optimize third-party risk management. A centralized ESG platform offers a unified view of partner compliance. In retail, this simplifies regulatory compliance and reduces the cost of third-party evaluations — while effectively addressing supply chain sustainability issues.

Integrating ESG reporting into third-party oversight is key to meeting the growing expectations of investors and regulators. According to Harvard Law School, 2025 marks a shift from voluntary, qualitative ESG reports to mandatory, data-driven ones, subject to limited assurance by third parties. This evolution requires robust data collection and governance processes to ensure operational stability across the business ecosystem.

Toward Collaborative and Resilient Third-Party Governance

Unified ESG metrics mark a turning point in third-party compliance management. As we’ve seen, fragmented tools are no longer suited to rising regulatory demands and modern supply chain complexity.

An integrated ESG solution not only provides a unified view of compliance but also transforms third-party governance into a shared, collaborative process. This yields sustainable performance on multiple fronts: up to 30% reduction in evaluation costs, improved data quality, and greater investor confidence. According to Jedox, companies that centralize ESG data benefit from a “holistic approach” that “streamlines processes and unlocks optimization potential.”

By leveraging sector expertise, technological innovation, and deep understanding of EU regulations, organizations can build long-term operational resilience in the face of ESG challenges. The future belongs to companies that turn compliance into strategic opportunity by placing ESG data centralization at the heart of sustainable transformation.

Ready to unlock the full potential of every third-party relationship?

Discover how Aprovall360 can help you centralize ESG data and strengthen third-party governance.

These articles might interest you

-

14 July 2024Duty of vigilance: A recent international report warns of companies’ non-compliance, particularly in FranceSolutionsThe World Benchmarking Alliancehas just published a report analyzing the practices of the 2,000 most important companies on the planet in terms of human rights due diligence. The “alarming” results show companies’ delay in this area, and French companies are far from being an exception to the rule. The countdown has begun before the European […]

14 July 2024Duty of vigilance: A recent international report warns of companies’ non-compliance, particularly in FranceSolutionsThe World Benchmarking Alliancehas just published a report analyzing the practices of the 2,000 most important companies on the planet in terms of human rights due diligence. The “alarming” results show companies’ delay in this area, and French companies are far from being an exception to the rule. The countdown has begun before the European […]Read more

-

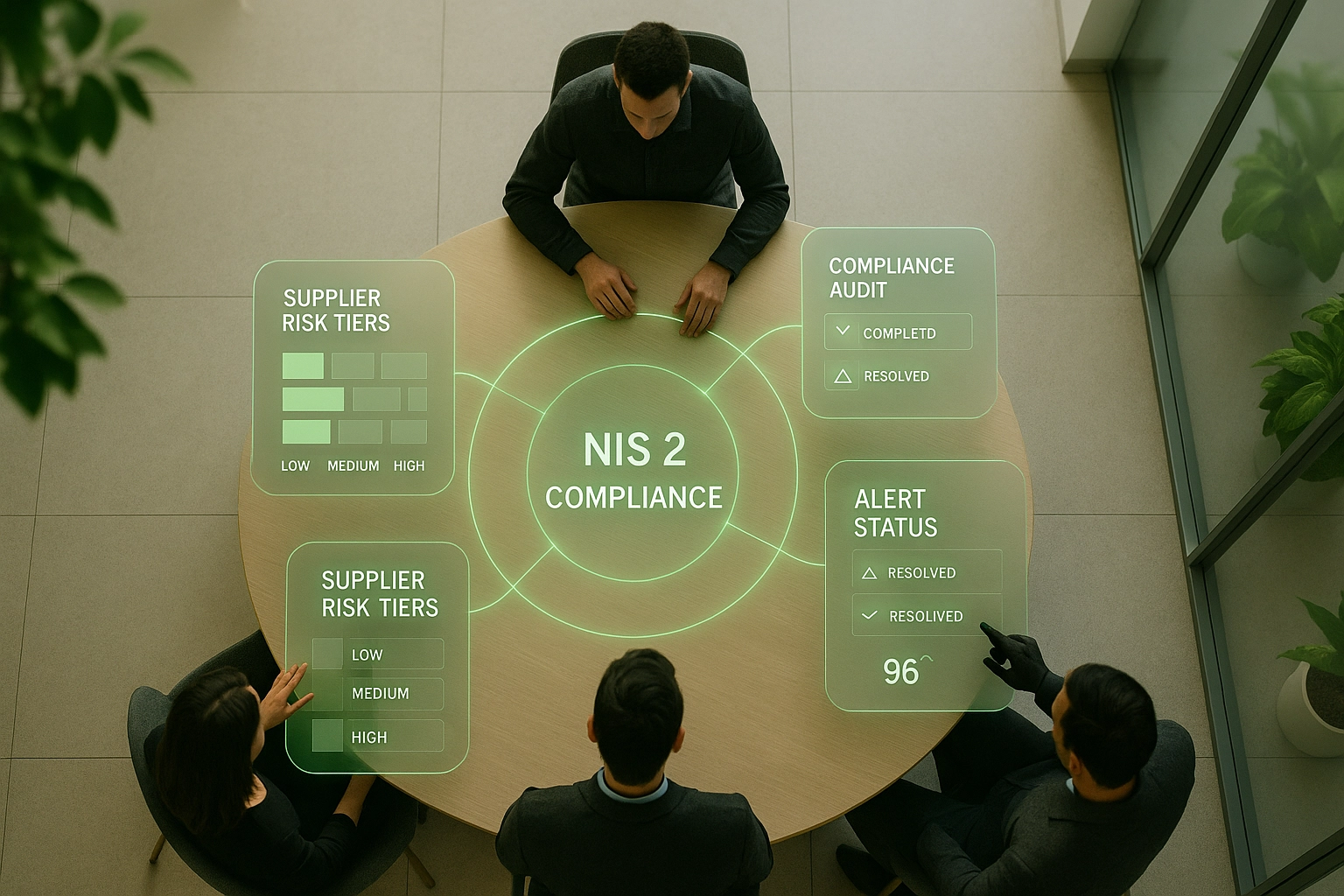

21 April 2025NIS2: Understanding the Obligations of Critical SuppliersSolutionsThe NIS2 Directive redefines cybersecurity requirements for critical entities and their third-party governance across Europe. With over 1.8 million companies indirectly affected via their supply chains (NIS2 Quality Mark – 2025), identifying critical third parties is now a strategic imperative for key sectors like construction and public services. This regulation mandates a dynamic mapping of […]

21 April 2025NIS2: Understanding the Obligations of Critical SuppliersSolutionsThe NIS2 Directive redefines cybersecurity requirements for critical entities and their third-party governance across Europe. With over 1.8 million companies indirectly affected via their supply chains (NIS2 Quality Mark – 2025), identifying critical third parties is now a strategic imperative for key sectors like construction and public services. This regulation mandates a dynamic mapping of […]Read more

-

14 February 2025Supply Chain and Cyber Risks: How to Protect Your Supply Chain?SolutionsThe digital transformation of supply chains creates new opportunities but also exposes organizations to growing vulnerabilities. In 2025, third-party compliance assessment and management becomes a major strategic issue as 45% of global organizations will have suffered supply chain attacks, three times more than in 2021. Given this shift, third-party governance has become a top priority, especially in critical sectors such as […]

14 February 2025Supply Chain and Cyber Risks: How to Protect Your Supply Chain?SolutionsThe digital transformation of supply chains creates new opportunities but also exposes organizations to growing vulnerabilities. In 2025, third-party compliance assessment and management becomes a major strategic issue as 45% of global organizations will have suffered supply chain attacks, three times more than in 2021. Given this shift, third-party governance has become a top priority, especially in critical sectors such as […]Read more

-

03 December 2025How TPRM Solutions Help Procurement Teams Cut Administrative Workload by 25%SolutionsReducing repetitive administrative tasks is one of the top priorities for Procurement Departments—so teams can focus on strategy, performance, and supplier relationships. The current landscape only adds pressure. Procurement professionals juggle multiple demands alongside increasing risks: climate, geopolitical, social—not to mention the classic ones: financial, environmental, cybersecurity, and human rights-related. SRM tools offer a first […]

03 December 2025How TPRM Solutions Help Procurement Teams Cut Administrative Workload by 25%SolutionsReducing repetitive administrative tasks is one of the top priorities for Procurement Departments—so teams can focus on strategy, performance, and supplier relationships. The current landscape only adds pressure. Procurement professionals juggle multiple demands alongside increasing risks: climate, geopolitical, social—not to mention the classic ones: financial, environmental, cybersecurity, and human rights-related. SRM tools offer a first […]Read more