Optimizing ESG Evaluation Tools: Enhance Your Supplier Processes

Faced with increasing regulatory pressure and the rise of sustainable transformation, organizations must rethink their third-party governance. Integrating ESG criteria into third-party evaluation tools has become a critical lever to meet regulatory requirements and the growing expectations of stakeholders. Even with the temporary suspension of CS3D, many companies now view supplier ESG commitment as a key risk factor to assess.

This article is designed for organizations that have already deployed ESG evaluation tools and are seeking to optimize existing performance, as well as for companies looking to incorporate ESG criteria into their supplier selection and sourcing processes. Rather than starting from scratch, we help improve current workflows to increase efficiency, reduce administrative burden, and maximize the value of collaborative evaluations.

Where Does ESG Integration Stand Today?

In many organizations, supplier assessments still rely on traditional frameworks: ISO quality certifications, REACH declarations, regulatory attestations, or simple questionnaires. Collaborative approaches are limited, and meaningful responsible initiatives are rarely treated as strategic assets.

The arrival of the CSRD changes this balance: ESG reporting requires reliable, comparable data across stakeholders. According to the 2024 Observatoire des Achats Responsables, only 32% of French companies have ESG evaluation tools integrated into their procurement processes. Managing ESG risks from the selection stage and throughout the supplier lifecycle is essential to operational resilience, especially in complex, international supply chains.

This shift is accelerating in the manufacturing sector, where large contractors now impose standardized ESG criteria. CAC 40 companies have tripled their ESG documentation requirements for critical suppliers since the directive’s enactment. To meet this challenge, optimize your ESG supply chain strategy and build a sector-specific, structured methodology.

Examples of optimization based on your current tools

Excel questionnaires

Migrate to automated collaborative platforms

Basic ERP/SRM modules

Enrich with predictive ESG scoring and real-time alerts

Static supplier portals

Add smart workflows and dynamic dashboards

One-off manual audits

Switch to continuous monitoring using AI and anomaly detection

Why Strengthen ESG Criteria?

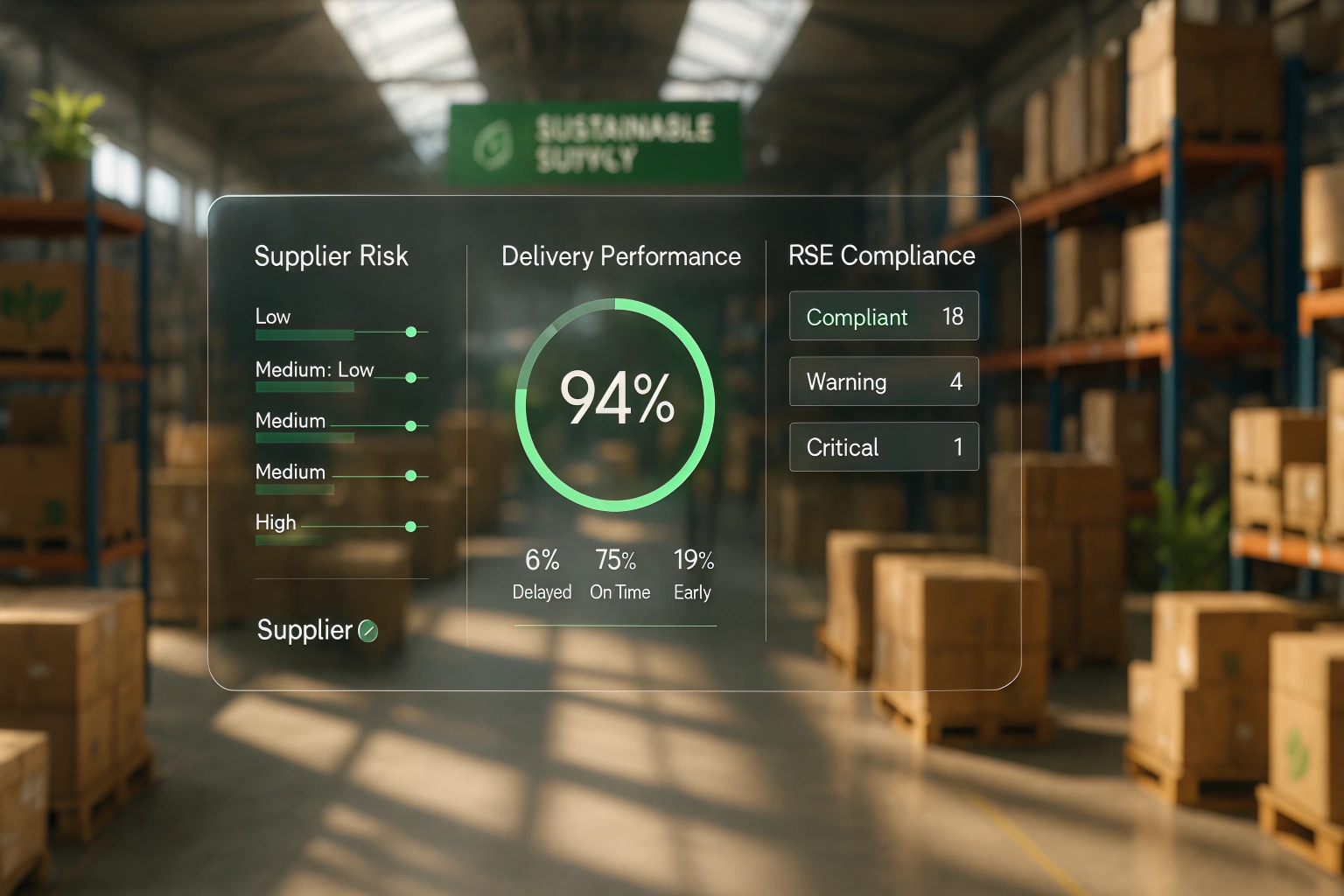

Proactively managing ESG criteria brings measurable benefits to operational resilience. It reduces reputational risk by ensuring partners align with the expectations of consumers and investors. Systematic use of sustainability indicatorsbroadens your ESG performance perspective beyond minimum compliance.

Stronger third-party governance on ESG creates operational gains. According to the 2024 EcoVadis study, companies incorporating ESG into supplier evaluations reduce non-compliance incidents by 23% and improve overall supply chain performance by 18%. It also enables better regulatory anticipation and smoother responsible purchasing workflows.

Sector feedback confirms that a collaborative approach boosts CSR oversight and delivers a long-term competitive advantage.

Main Roadblocks to ESG Optimization

Despite growing consensus on ESG’s importance, several barriers slow the transformation of evaluation processes. Sector-specific diversity makes it hard to create harmonized, fit-for-purpose criteria. Many procurement tools still don’t allow for detailed collection or dynamic tracking of ESG indicators.

Overloading partners with redundant or excessive demands leads to supplier fatigue. Long questionnaires and non-collaborative processes reduce data reliability and discourage engaged suppliers—especially in public construction or heavy industries.

Lack of automation is another major barrier. Manual approaches struggle to handle increasing ESG data volumes, reducing organizations’ ability to spot emerging risks and measure sustainable impact. To address this, optimize your supplier ESG evaluations and implement a collaborative methodology that minimizes overhead while maximizing added value.

How to Implement a Step-by-Step Methodology

Step 1: Audit Your Existing Processes

Optimizing an existing ESG strategy starts with auditing your current tools. Are your questionnaires creating supplier fatigue? Are ESG indicators used in decision-making? A detailed review highlights covered ESG areas, assesses information quality, and benchmarks your maturity level against CSRD standards.

Involving key internal stakeholders (procurement, supply chain, compliance) encourages ownership and helps prioritize action. In industrial contexts, this stage also verifies whether ICPE compliance is addressed in supplier risk analysis. A collaborative approach avoids siloed decision-making and builds a shared vision of ESG priorities.

Step 2: Select and Structure Key ESG Criteria

Rationalizing current ESG criteria often starts with simplification. Analyze existing criteria to remove redundancy, drop low-impact indicators, and strengthen decision-critical ones. Criteria should match the business context: CO2 for industry, social traceability for retail, water use in construction.

It’s better to focus on a concise set of actionable ESG indicators than chase exhaustiveness. According to the 2024 Altares-D&B study, integrating ESG scores into evaluations cuts third-party management time by 25% and reduces supplier fatigue.

Formalizing criteria using European benchmarks or CSRD-aligned references ensures adoption. Standardization also enables sector-level comparability of environmental, social, and governance performance.

Step 3: Operational Integration and Change Management

Next, ESG criteria should be embedded in existing workflows—not added as side processes. Enriching platforms (SRM, ERP, partner portals) with ESG modules improves collection without extra steps. Native integration avoids interface overload and simplifies user experience.

In retail, adding a few targeted questions on responsible purchasing at key moments (qualification, contract renewal, annual review) improves decision-making without increasing complexity. Automation handles high volumes of ESG data while maintaining evaluation reliability.

Change management is critical: targeted training, user guides, and regular feedback support ESG adoption. When tools enable narrative input, partner engagement rises significantly. Personalized technical support eases the transition and overcomes resistance.

Finally, continuous performance tracking is essential: completeness rates, response time, partner satisfaction, and quarterly supplier fatigue indicators.

Key ESG maturity indicators to track

> 85%

Completion rate

< 15 jours

Average supplier response time

> 60%

Automated evaluations

> 7/10

Partner satisfaction score

Reduction

Quarterly reduction in supplier fatigue

Source : Avasant 2024-2025

Optimization by Tool Type

SRM/ERP Platforms: Functional Enrichment

Organizations using ERP-integrated ESG modules (SAP Ariba, Oracle, Ivalua) can optimize via predictive scoring and automated alerts. External APIs can enrich supplier profiles with updated ESG data.

Specialized Solutions: Upgrading to Collaborative Models

Users of platforms like EcoVadis or Sustainalytics can increase ROI by improving customized workflows and using sector benchmarking tools to identify top-performing partners.

Internal Tools: Gradual Professionalization

Organizations with in-house tools can integrate recognized standards (GRI, SASB) and automate data collection to reduce manual work and improve reliability.

Sector Insights and Lessons Learned

Manufacturing: Advanced Integration and Streamlining

In manufacturing, contractor pressure has driven widespread ESG integration into supply chain systems. Some platforms now automate energy KPI collection and compliance tracking, enabling agile action plans and audit-ready traceability.

The TELT experience with 4,500 partners shows that a user-friendly platform promotes adoption across regions. This collaborative model supports effective third-party governance in complex international environments.

Streamlined ESG indicators increase analytical clarity and reduce documentation burdens for suppliers. Simplicity fosters transparency and constructive dialogue on shared ESG challenges.

Retail and Distribution: Standardization and Tailored Support

Retail success relies on standardizing key criteria (working conditions, anti-corruption, diversity) and offering real-world examples. Constant partner support facilitates high-value collaborative evaluations, significantly reducing supplier fatigue.

Top retailers focus on four areas

Simplifying workflows via ESG data automation

Highlighting innovations in traceability and social engagement

Adapting tools to partner maturity

Tracking progress with transparent communication

Explore these sector strategies with TPRM and TPGRC tools transforming retail and distribution to enhance operational resilience.

ESG Optimization and Continuous Performance Tracking

Optimizing ESG tools requires a cultural shift toward proactive third-party governance. Success depends on visibility and recognition of ESG performance milestones. This cultural change calls for greater transparency and collaboration across internal workflows.

Alignment with CSRD-compliant ESG reporting frameworks boosts credibility among stakeholders and simplifies audit prep. Companies that standardize ESG processes improve data quality and reduce regulatory gaps.

In the long run, only continuous processes combining tech agility, shared frameworks, and strong change support can balance compliance demands, efficiency, and shared value across the supply chain. To structure this transformation, develop a holistic risk management approach that naturally embeds ESG in your collaborative processes.

These articles might interest you

-

14 May 2025Environmental Criteria for Third-Party Partner EvaluationSecteurMore and more companies are incorporating environmental preservation into their overall strategy. Whether through sustainable practices or compliance with the CSRD (Corporate Sustainability Reporting Directive), these organizations aim to reduce their ecological footprint. The evaluation of suppliers plays a crucial role in this process, using various environmental criteria to ensure a responsible supply chain. What […]

14 May 2025Environmental Criteria for Third-Party Partner EvaluationSecteurMore and more companies are incorporating environmental preservation into their overall strategy. Whether through sustainable practices or compliance with the CSRD (Corporate Sustainability Reporting Directive), these organizations aim to reduce their ecological footprint. The evaluation of suppliers plays a crucial role in this process, using various environmental criteria to ensure a responsible supply chain. What […]Read more

-

11 June 2025Decoding Gartner Evaluation Criteria for European Third-Party Governance PlatformsSecteurAs third-party governance becomes a cornerstone of operational resilience for organizations, Gartner’s Magic Quadrant evaluation standards stand out as an essential benchmark. However, their application within the European market demands a methodical adaptation to incorporate regulatory compliance with DORA, NIS 2, and CSRD, while ensuring data sovereignty and security. This dual imperative shapes how decision-makers in the […]

11 June 2025Decoding Gartner Evaluation Criteria for European Third-Party Governance PlatformsSecteurAs third-party governance becomes a cornerstone of operational resilience for organizations, Gartner’s Magic Quadrant evaluation standards stand out as an essential benchmark. However, their application within the European market demands a methodical adaptation to incorporate regulatory compliance with DORA, NIS 2, and CSRD, while ensuring data sovereignty and security. This dual imperative shapes how decision-makers in the […]Read more

-

26 September 2025How to Identify Risks Across Your Entire Supply ChainSecteurAs supply chains grow more complex and geographically dispersed, companies can no longer afford to assess only their direct suppliers. Major risks—whether related to cybersecurity, corruption, or production continuity—can emerge much deeper in the chain. A single raw material supplier at tier 8 can jeopardize an entire production line. This is why expanding risk assessments […]

26 September 2025How to Identify Risks Across Your Entire Supply ChainSecteurAs supply chains grow more complex and geographically dispersed, companies can no longer afford to assess only their direct suppliers. Major risks—whether related to cybersecurity, corruption, or production continuity—can emerge much deeper in the chain. A single raw material supplier at tier 8 can jeopardize an entire production line. This is why expanding risk assessments […]Read more

-

10 February 2025How TPRM and TPGRC Solutions Are Transforming the Retail and Distribution Sector in 2025SecteurThe retail and distribution sector plays a crucial role in the French economy, orchestrating a vast network of subcontractors and suppliers. These stakeholders contribute to both supply chain management and the final customer experience. Among them, installers and delivery partners represent critical links in the value chain. However, this sector faces major challenges: ensuring subcontractor […]

10 February 2025How TPRM and TPGRC Solutions Are Transforming the Retail and Distribution Sector in 2025SecteurThe retail and distribution sector plays a crucial role in the French economy, orchestrating a vast network of subcontractors and suppliers. These stakeholders contribute to both supply chain management and the final customer experience. Among them, installers and delivery partners represent critical links in the value chain. However, this sector faces major challenges: ensuring subcontractor […]Read more