How TPRM Maximizes the Management of Class C Suppliers

The Class C Supplier Paradox

In most organizations, the management of Class C suppliers is built on a well-known paradox: they represent only about 20% of total procurement spend, but consume nearly 80% of the procurement team’s time. These suppliers, often non-strategic and outside of core production, generate a high volume of invoices, administrative tasks, and repetitive processing that weighs heavily on buyers’ day-to-day work. Their economic impact is low, but their sheer number creates a disproportionate workload.

Class C suppliers are typically defined by low purchase volumes, limited criticality to operations, and a restricted operational contribution. Yet, despite their relative importance, they make up the majority of the supplier panel. These are low-value actors whose management is still necessary—particularly for meeting regulatory obligations. Monitoring them requires numerous time-consuming tasks: document collection, follow-ups, social or tax certificate verification, data updates, mass invoice processing… all of which consume time without directly contributing to procurement performance.

Risk Management Is Still Essential

The paradox deepens when we consider the risks involved. Even if these suppliers are not strategic, they must still meet minimum compliance requirements. Buyers must verify legal obligations, monitor insurance, assess ESG risks, ensure basic cybersecurity measures, and avoid undeclared labor situations. The challenge lies in the fact that these “small” suppliers often respond late—or not at all—and their document completeness rate is structurally low. The result is a cascade of follow-ups and checks that heavily burden internal teams.

TPRM Solutions Streamline Class C Supplier Evaluations

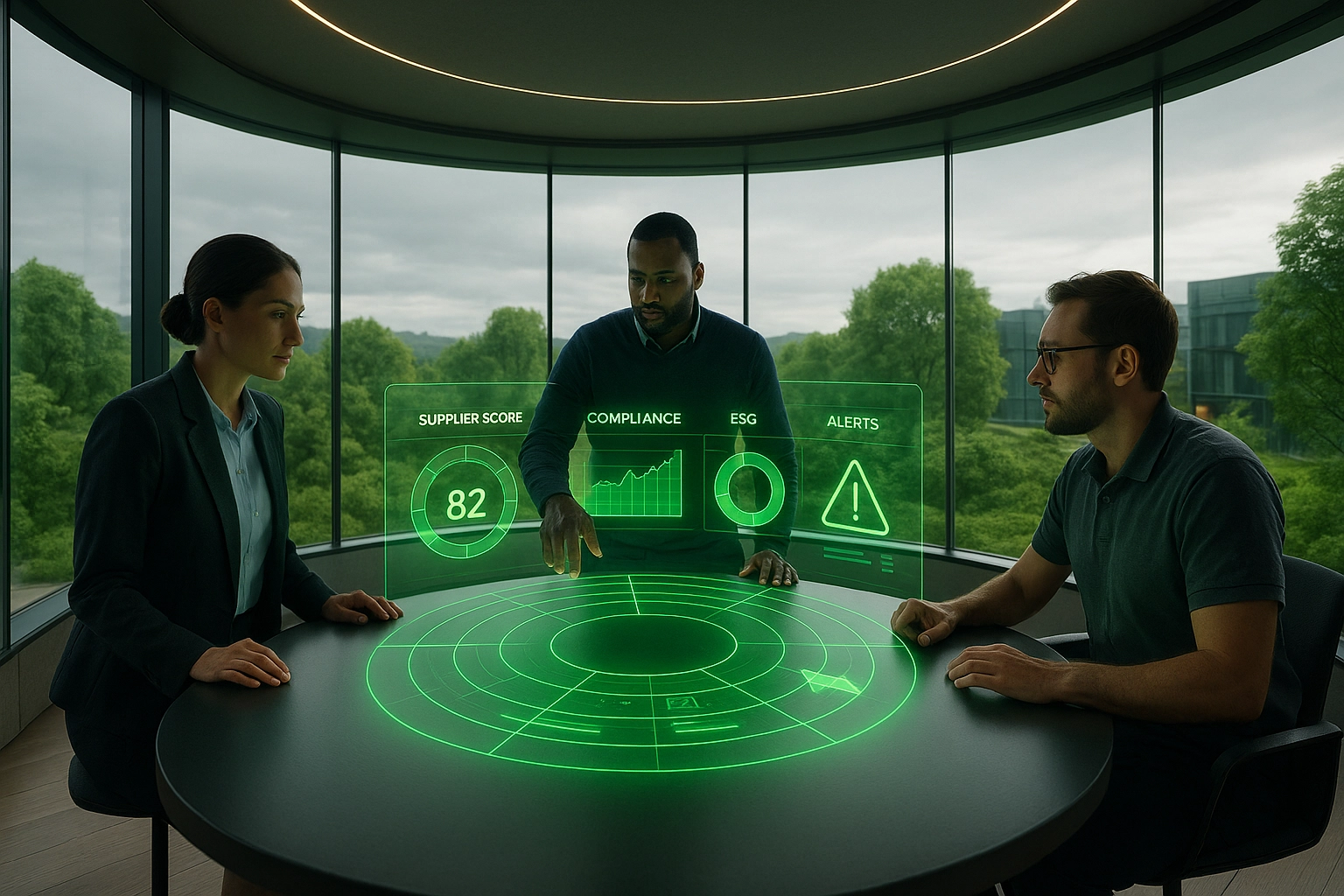

This is exactly where TPRM (Third-Party Risk Management) solutions provide a structured answer. They automate the majority of tedious steps: onboarding is guided, document collection is automated, follow-ups are scheduled, and legal checks are performed continuously. This automation saves precious time and improves tracking reliability while making the process smoother for less engaged suppliers. Evaluations are also adapted to actual criticality levels, with simplified questionnaires designed to maximize completeness and avoid overburdening third parties.

Dedicated dashboards offer instant visibility into pending files, residual risks, expired documents, and the overall compliance status of the Class C portfolio. Finally, a lesser-known but crucial benefit lies in identifying the ownership structure of these smaller suppliers. Some of them turn out to be part of strategic groups or linked to key partners. Identifying these relationships helps streamline the panel, consolidate procurement, and avoid dependency or duplication.

Ultimately, managing Class C suppliers should no longer be seen as an administrative burden. With the right TPRM in place, organizations can reduce operational load, improve compliance, manage essential risks, and free up teams to focus on the suppliers who truly create value for the business.

And Why Not Outsource the Management of Class C Suppliers?

Some companies choose to fully outsource the management of their suppliers to specialized players like AGP. Supported by TPRM, ERP, and SRM solutions, these providers handle the entire relationship: from operational follow-up to order management and volume optimization. This allows for full oversight and more efficient management of your supplier ecosystem.

Ready to strengthen your third-party risk management program?

These articles might interest you

-

14 September 2024Aprovall supports you in your new due diligence obligations arising from the European CS3D Directive.SolutionsThe Corporate Sustainability Due Diligence Directive, known as “CS3D”, was definitively adopted on Wednesday, April 24, 2024, by the European Parliament. The directive now needs to be officially approved by the Council and signed before being published in the EU Official Journal. It will enter into force 20 days later. Member States will then have […]

14 September 2024Aprovall supports you in your new due diligence obligations arising from the European CS3D Directive.SolutionsThe Corporate Sustainability Due Diligence Directive, known as “CS3D”, was definitively adopted on Wednesday, April 24, 2024, by the European Parliament. The directive now needs to be officially approved by the Council and signed before being published in the EU Official Journal. It will enter into force 20 days later. Member States will then have […]Read more

-

30 June 2025Assess the ESG maturity of third-party partners to optimize your carbon footprintSolutionsAssessing the ESG maturity of your third-party partners directly impacts your sourcing strategy and the environmental footprint of your operations. Identifying the level of environmental commitment and compliance within your partner ecosystem is now a critical insight for any organization aiming to improve sustainable performance. However, collecting the necessary documents and data can be complex […]

30 June 2025Assess the ESG maturity of third-party partners to optimize your carbon footprintSolutionsAssessing the ESG maturity of your third-party partners directly impacts your sourcing strategy and the environmental footprint of your operations. Identifying the level of environmental commitment and compliance within your partner ecosystem is now a critical insight for any organization aiming to improve sustainable performance. However, collecting the necessary documents and data can be complex […]Read more

-

16 January 2025TPRM Platform: Essential Features for Modern Third-Party Risk ManagementSolutionsAs third-party risk management becomes a strategic priority, TPRM platforms (Third Party Risk Management) are emerging as a must-have standard. This shift responds to a dual imperative: ensuring operational continuity and meeting increasingly complex multi-country regulatory compliance. With over 430,000 third-party vendors assessed across Europe, Aprovall’s experience has helped define the essential features of a modern TPRM platform—now evolving into a broader […]

16 January 2025TPRM Platform: Essential Features for Modern Third-Party Risk ManagementSolutionsAs third-party risk management becomes a strategic priority, TPRM platforms (Third Party Risk Management) are emerging as a must-have standard. This shift responds to a dual imperative: ensuring operational continuity and meeting increasingly complex multi-country regulatory compliance. With over 430,000 third-party vendors assessed across Europe, Aprovall’s experience has helped define the essential features of a modern TPRM platform—now evolving into a broader […]Read more

-

17 March 2025Understanding Third-Party Cybersecurity Maturity: Keys to Effective AssessmentSolutionsThird-party governance has become a major strategic issue in an economic context marked by the growing interdependence between companies and their external partners. According to Gartner, 45% of cyberattacks in 2025 will originate from third parties, highlighting the urgency of a structured evaluation approach. Operational resilience against these threats now requires a shift from simple […]

17 March 2025Understanding Third-Party Cybersecurity Maturity: Keys to Effective AssessmentSolutionsThird-party governance has become a major strategic issue in an economic context marked by the growing interdependence between companies and their external partners. According to Gartner, 45% of cyberattacks in 2025 will originate from third parties, highlighting the urgency of a structured evaluation approach. Operational resilience against these threats now requires a shift from simple […]Read more