TPRM Platform: Essential Features for Modern Third-Party Risk Management

As third-party risk management becomes a strategic priority, TPRM platforms (Third Party Risk Management) are emerging as a must-have standard. This shift responds to a dual imperative: ensuring operational continuity and meeting increasingly complex multi-country regulatory compliance. With over 430,000 third-party vendors assessed across Europe, Aprovall’s experience has helped define the essential features of a modern TPRM platform—now evolving into a broader TPGRC (Third Party Governance & Risk Compliance) approach.

Third-Party Risk Assessment and Management

The core of an effective TPRM strategy lies in structured risk evaluation and monitoring. A robust TPRM platform must enable continuous risk assessment of external partners.

Key pillars include:

Initial and Ongoing Assessments

- Tailored questionnaires based on relationship criticality and risk mapping

- AI-powered automated document collection and analysis

- Multi-dimensional evaluation: cybersecurity, data protection, business ethics, environmental compliance

- A risk-based approach using objective scoring criteria

Smart Automation

- Automated data collection and analysis

- Reduced administrative burden for partners (avoiding supplier fatigue)

- Fast identification of risk profile changes

In the public sector, especially after EU Regulation 2022/576, third-party assessment has become a regulatory cornerstone. Platforms must classify risks by criticality, using a shared knowledge base to streamline decisions.

Due Diligence and Reasonable Vigilance

Collaborative due diligence is key to effective third-party governance. According to recent studies, 57% of organizations plan to intensify third-party evaluation in the next two years. This trend reflects the growing complexity of compliance landscapes.

The most effective TPRM platforms offer multi-tiered risk analysis:

- Basic verification

- Enhanced due diligence

- Deep audits for critical partners (site visits, in-depth interviews)

Automation is crucial—especially when 60%+ of companies manage over 1,000 vendors, often internationally. Reducing administrative load while securing trustworthy data is essential. et Due Diligence

Continuous Monitoring

Beyond onboarding, a TPRM platform must ensure real-time monitoring of potential risk events. According to Gartner, 76% of major third-party incidents in 2024 could have been anticipated through proactive alerts.

Features to include:

- Certification and compliance tracking

- Financial and operational performance monitoring

- Cybersecurity incident detection

- Structural change monitoring (M&A, leadership changes)

To ensure data freshness, the platform should allow third parties to proactively update their profiles, free of charge.

Want to assess the maturity of your third-party risk program?

Regulatory Compliance

Compliance is now a strategic imperative. According to PwC, 78% of organizations view regulatory compliance as key to digital transformation.

Must-have capabilities:

- Automated certification tracking

- Real-time monitoring of regulatory changes

- Sector-specific evaluation workflows

- Customizable compliance dashboards

An efficient platform supports cross-regulatory governance across frameworks like DORA, NIS 2, GDPR, helping reduce non-compliance costs by an average of 20%.

Internal Integration

A best-in-class TPRM solution must integrate seamlessly with:

- Risk management tools

- ERP and SRM platforms

- Compliance systems

This ensures workflow harmonization and cross-functional alignment, such as IT and Legal teams collaborating on security risk management.

Process Automation and Simplification

Simplifying and automating workflows is a core TPRM value. Essential capabilities:

- Smart workflows adapted to risk profiles

- Automated document and certification collection

- Real-time alerts and deadlines

- Collaborative validation

According to Gartner, TPRM automation reduces admin time by 45%, freeing resources for higher-value risk analysis tasks.

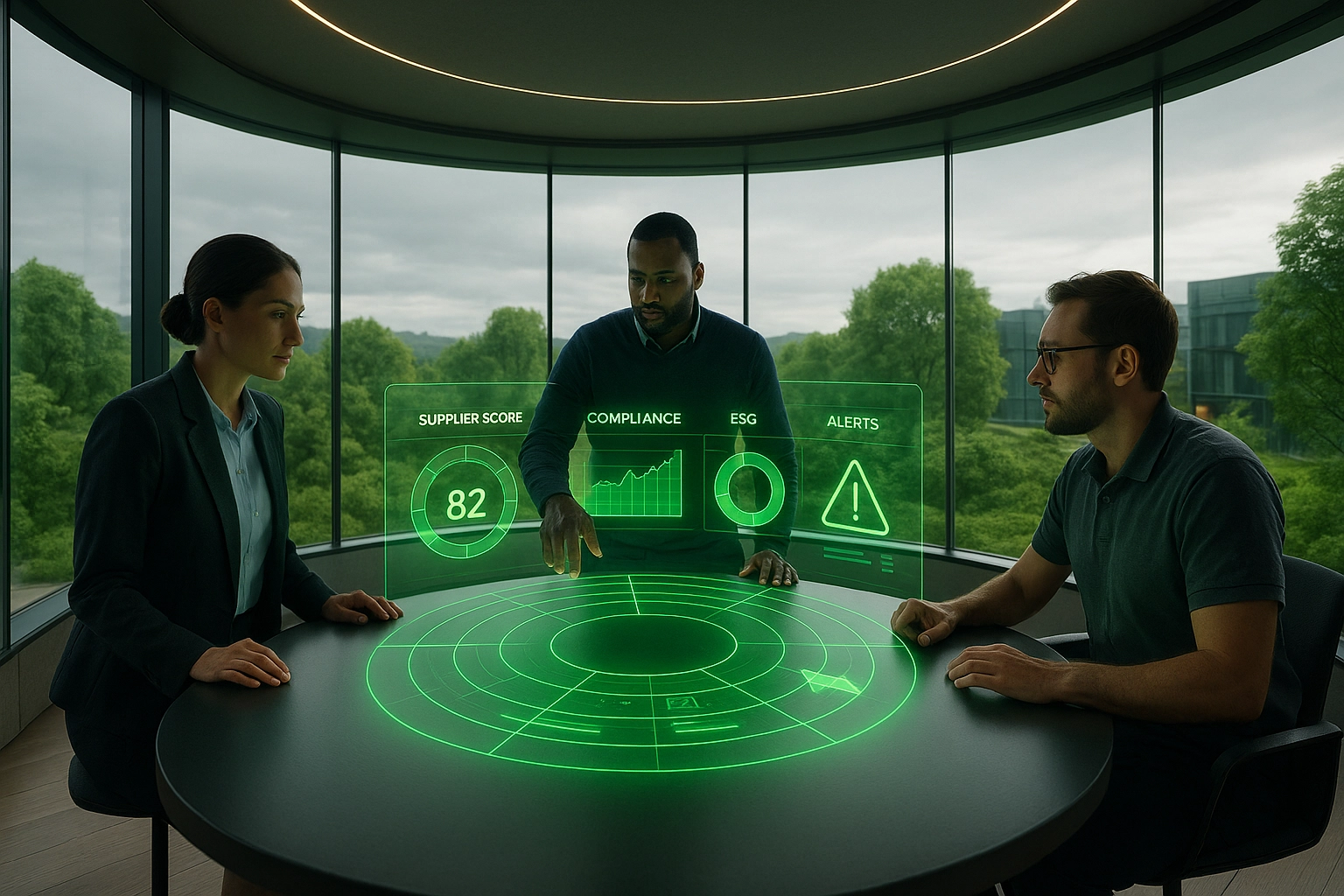

Purpose-Built Tools

Risk teams need intuitive tools that combine analysis and actionable insights. A modern platform should include:

- In-depth analytics reports

- Interactive dashboards

- Real-time alerting

- Standardized contract clause templates

These features ensure that companies have all the necessary resources to handle contingencies and maintain proactive risk management.

Cybersecurity Focus

Cyber risk is now central to third-party governance. According to Gartner’s 2024 Third-Party Risk Report, 82% of major cyber incidents involve external vendors.

A TPRM platform should provide:

- Security certification monitoring

- Known vulnerability scanning

- Security policy audits

- Business continuity plan verification

IBM’s 2024 report estimates the average cost of a third-party breach at €4.33M, highlighting the importance of continuous evaluation.

TPRM Implementation: A Strategic Project

Implementing a TPRM platform requires methodical planning. Deloitte found that 73% of successful digital transformations begin with detailed evaluation.

Recommended steps:

- Define objectives and initial scope

- Map existing processes

- Identify critical third parties

- Train teams and promote best practices

Gartner suggests starting with the 20% most critical vendors, which typically represent 80% of total risk.

Ready to transform your third-party risk strategy?

Benefits of Centralized TPRM Platforms

A centralized platform enhances:

- Visibility across third-party relationships

- Cross-department collaboration

- Contract and documentation management

- Responsiveness to emerging risks

It supports stronger governance and helps reduce risks across all tiers of your supplier ecosystem.

Aprovall supports organizations at all maturity levels, with sector-tailored solutions addressing key concerns from cyber risk to ESG alignment and supplier failure mitigation.

These articles might interest you

-

08 July 2025Why integrate media monitoring into your third-party evaluation?SolutionsWith the rapid acceleration of digital information and the proliferation of media sources, real-time monitoring of your third-party partners’ media presence has become a critical strategic issue. Media monitoring is now an essential part of collaborative evaluation processes for any analyst seeking a comprehensive view of third-party risk. Whether the information is positive or negative, […]

08 July 2025Why integrate media monitoring into your third-party evaluation?SolutionsWith the rapid acceleration of digital information and the proliferation of media sources, real-time monitoring of your third-party partners’ media presence has become a critical strategic issue. Media monitoring is now an essential part of collaborative evaluation processes for any analyst seeking a comprehensive view of third-party risk. Whether the information is positive or negative, […]Read more

-

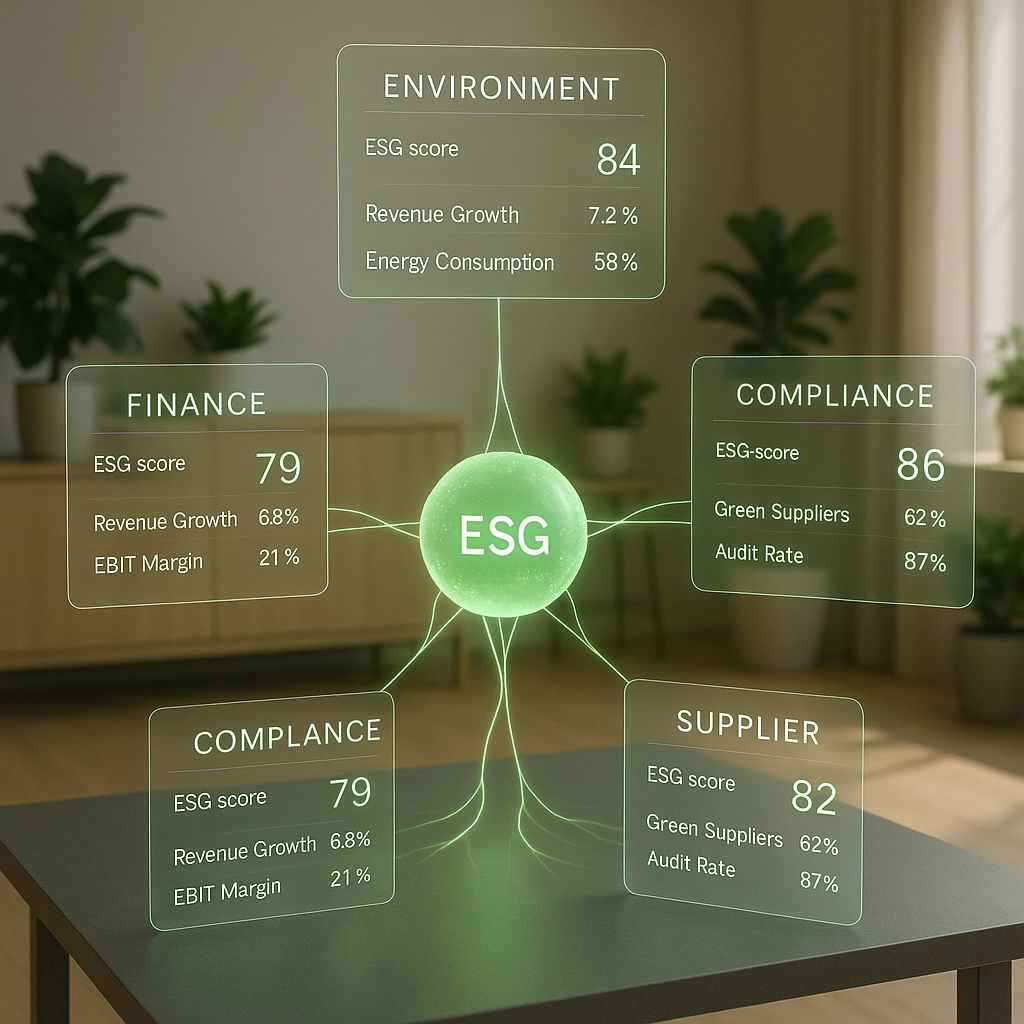

23 April 2025ESG Platforms: Centralized Data for Sustainable PerformanceSolutionsThe growing interest of investors and businesses in Environmental, Social, and Governance (ESG) criteria comes with significant challenges in assessing third-party partners. According to the DLA Piper report, ESG evaluation of external providers has become critical, particularly with the CS3D directive (Corporate Sustainability Due Diligence) coming into force on July 25, 2024. This directive requires […]

23 April 2025ESG Platforms: Centralized Data for Sustainable PerformanceSolutionsThe growing interest of investors and businesses in Environmental, Social, and Governance (ESG) criteria comes with significant challenges in assessing third-party partners. According to the DLA Piper report, ESG evaluation of external providers has become critical, particularly with the CS3D directive (Corporate Sustainability Due Diligence) coming into force on July 25, 2024. This directive requires […]Read more

-

23 January 2025Optimizing Productivity Through Automated Due DiligenceSolutionsAmid increasing regulatory demands and the growing complexity of value chains, third-party governance has become a strategic imperative for European organizations. With over 430,000 third parties managed on its platform, Aprovall supports this transformation by combining regulatory expertise with technological innovation. Automated due diligence is revolutionizing third-party evaluation by leveraging AI-powered predictive document analysis, sector-specific intelligent workflows, and real-time multi-source […]

23 January 2025Optimizing Productivity Through Automated Due DiligenceSolutionsAmid increasing regulatory demands and the growing complexity of value chains, third-party governance has become a strategic imperative for European organizations. With over 430,000 third parties managed on its platform, Aprovall supports this transformation by combining regulatory expertise with technological innovation. Automated due diligence is revolutionizing third-party evaluation by leveraging AI-powered predictive document analysis, sector-specific intelligent workflows, and real-time multi-source […]Read more

-

17 February 2025Supplier Due Diligence: A Key Pillar in Risk ManagementSolutionsSupplier due diligence has become a critical component of third-party governance in a context where nearly 50% of mergers fail due to inadequate partner assessment. This structured approach to collaborative evaluation enables organizations to build operational resilience while ensuring regulatory compliance. The due diligence process is based on a proven methodology of gathering and analyzing third-party information. It systematically covers six critical […]

17 February 2025Supplier Due Diligence: A Key Pillar in Risk ManagementSolutionsSupplier due diligence has become a critical component of third-party governance in a context where nearly 50% of mergers fail due to inadequate partner assessment. This structured approach to collaborative evaluation enables organizations to build operational resilience while ensuring regulatory compliance. The due diligence process is based on a proven methodology of gathering and analyzing third-party information. It systematically covers six critical […]Read more