Third Parties: Why You Can No Longer Ignore Risk Convergence

When it comes to supplier management, focusing on a single risk often means exposing yourself to many others. For a long time, companies have concentrated on financial risks: solvency, credit ratings, payment delays… But recent crises have proven that supplier risks are multiple, systemic, and deeply interconnected. A supplier may be financially sound… yet vulnerable […]

Why Assessing Upstream Suppliers Is Essential

Upper-Tier Suppliers: The (Too Often) Overlooked Risk in Your Supply Chain Modern procurement chains rely on a multitude of actors, each contributing to value creation—extraction, manufacturing, assembly… The final product is never the result of a single supplier but rather the outcome of an often international ecosystem. Yet, most organizations still focus their efforts and […]

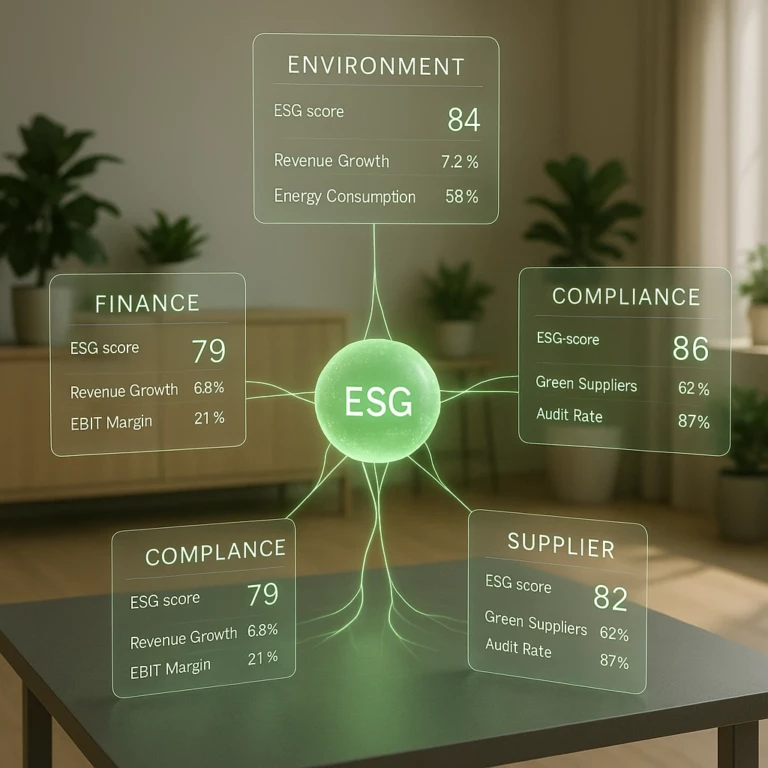

ESG Platforms: Centralized Data for Sustainable Performance

The growing interest of investors and businesses in Environmental, Social, and Governance (ESG) criteria comes with significant challenges in assessing third-party partners. According to the DLA Piper report, ESG evaluation of external providers has become critical, particularly with the CS3D directive (Corporate Sustainability Due Diligence) coming into force on July 25, 2024. This directive requires […]

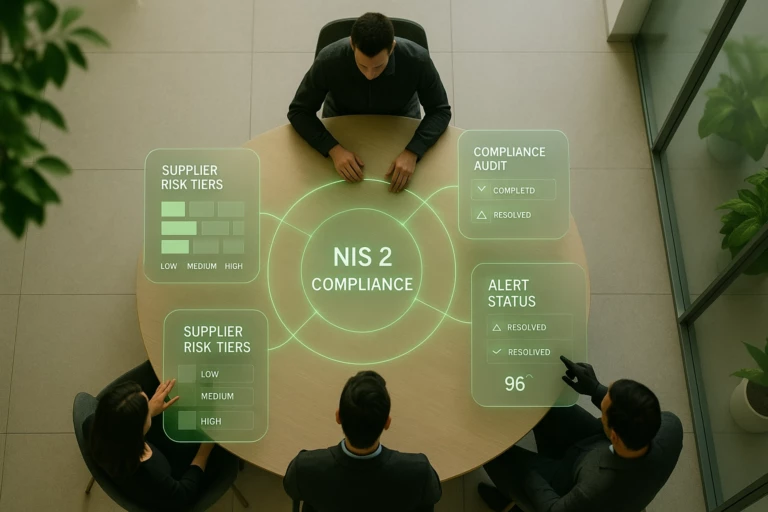

NIS2: Understanding the Obligations of Critical Suppliers

The NIS2 Directive redefines cybersecurity requirements for critical entities and their third-party governance across Europe. With over 1.8 million companies indirectly affected via their supply chains (NIS2 Quality Mark – 2025), identifying critical third parties is now a strategic imperative for key sectors like construction and public services. This regulation mandates a dynamic mapping of […]

ESG Strategy for the Supply Chain: Assessment and Management Methods

The ESG strategy (Environment, Social, Governance) has become a fundamental pillar of corporate operational resilience. According to the 2025 Supply Chain ESG Risk Outlook by LRQA, over half of sourcing countries are now classified as high or extreme ESG risk, challenging the common perception that Western markets are inherently safer. This new reality demands a […]

Automated Financial Scoring: Optimizing Third-Party Assessment

In today’s world of interconnected supply chains, businesses can no longer afford to manage their supplier relationships blindly. A partner’s financial health can quickly become a critical risk factor. This is precisely the view of procurement leaders, who rank the risk of third-party financial failure as their number one concern, according to the AgileBuyer study. […]

How to Assess the Financial Health of Your Third-Party Partners

Assessing the financial health of third-party partners has become a crucial element in ensuring the operational resilience of your supply chain. According to the 2023 report from the Financial Stability Board, economic interdependencies have significantly increased in recent years—bringing flexibility and innovation but also creating potential risks for financial stability if not properly managed. Understanding […]

Understanding Key Financial Indicators for Evaluating Your Third-Party Partners

In an economic environment where over 60% of European companies have faced operational incidents linked to their third-party partners, as highlighted by the European Central Bank in its Annual Report on Supervisory Activities, understanding and mastering key financial indicators has become essential for evaluating the stability of your business partners. These third-party assessment tools help […]

Understanding Scope 3 Assessment in the Value Chain

Anticipating Your Carbon Footprint by Assessing Suppliers and Identifying Scope 3 Maturity In a context where third-party environmental governance is becoming a major strategic issue, companies must now evaluate and manage the carbon impact of their entire value chain. Scope 3 assessment represents a considerable but essential challenge to ensure organizations’ operational resilience in the […]