TPRM: The Fundamentals and the Shift Toward Integrated Governance

Is your organization ready to handle a major cyberattack targeting one of your critical suppliers? In 2024, the breach at Change Healthcare exposed sensitive medical data of 190 million Americans and paralyzed healthcare systems for weeks—demonstrating just how vulnerable modern supply chains are. This wasn’t an isolated incident: 61% of organizations experienced a third-party data breach in 2023, with remediation costs typically 40% higher than for internal breaches.

Third-Party Risk Management (TPRM) has become a strategic priority for both public and private organizations. In a world where virtually every business (98%) relies on partners who have already experienced compromises, learning how to evaluate and manage risks associated with external partners is no longer optional—it’s critical for survival.

This article lays out the essential foundations of TPRM, explores its evolution toward TPGRC (Third Party Governance & Risk Compliance), and provides a structured methodology to transform your third-party risk management approach. You will learn how to:

- Map your third-party ecosystem effectively

- Implement collaborative risk assessments

- Deploy continuous monitoring to anticipate incidents

- Develop a proactive remediation strategy

With supply chains and subcontractor networks growing ever more complex, only a systematic and collaborative approach can ensure operational resilience in a constantly evolving threat landscape.

Introduction to Third Party Risk Management

TPRM identifies, evaluates, and monitors risks tied to your external partners. These risks may be cyber, financial, strategic, technological, or compliance-related. The goal is to protect your organization from potential disruptions and ensure continuous resilience.

In today’s interconnected supply chains, ignoring third-party risk can lead to severe consequences. TPRM is therefore essential for maintaining business continuity and minimizing disruptions.

Why Third-Party Governance is Strategic Today

Businesses increasingly rely on third parties for critical operations. A disruption at a supplier can quickly cascade through the entire organization. By adopting proactive measures through TPRM, companies can anticipate and mitigate these risks more effectively.

In January 2024, the Change Healthcare cyberattack demonstrated that a robust TPRM is essential not just for operational continuity but also for creating long-term value and competitive advantage.

The 4 Key Stages of Effective TPRM

Step 1: Comprehensive Mapping of the Third-Party Ecosystem

The foundation of any TPRM strategy is a thorough mapping of all third parties—direct suppliers, subcontractors, cloud providers, and managed service vendors. Mapping must extend to tier-2 and tier-3 suppliers when their role carries significant risk.

This mapping should be based on a structured methodology that evaluates the strategic importance of each relationship. High-performing organizations use criticality matrices to classify third parties by their impact on operations, compliance, and reputation—prioritizing resources and oversight accordingly.

Step 2: Collaborative Risk Assessment

A collaborative approach to risk assessment is critical and must evaluate five key dimensions:

- Data Security: Cybersecurity posture, protection of sensitive data, and compliance with standards like ISO 27001

- Financial Stability: Economic health, business continuity capabilities, and market resilience

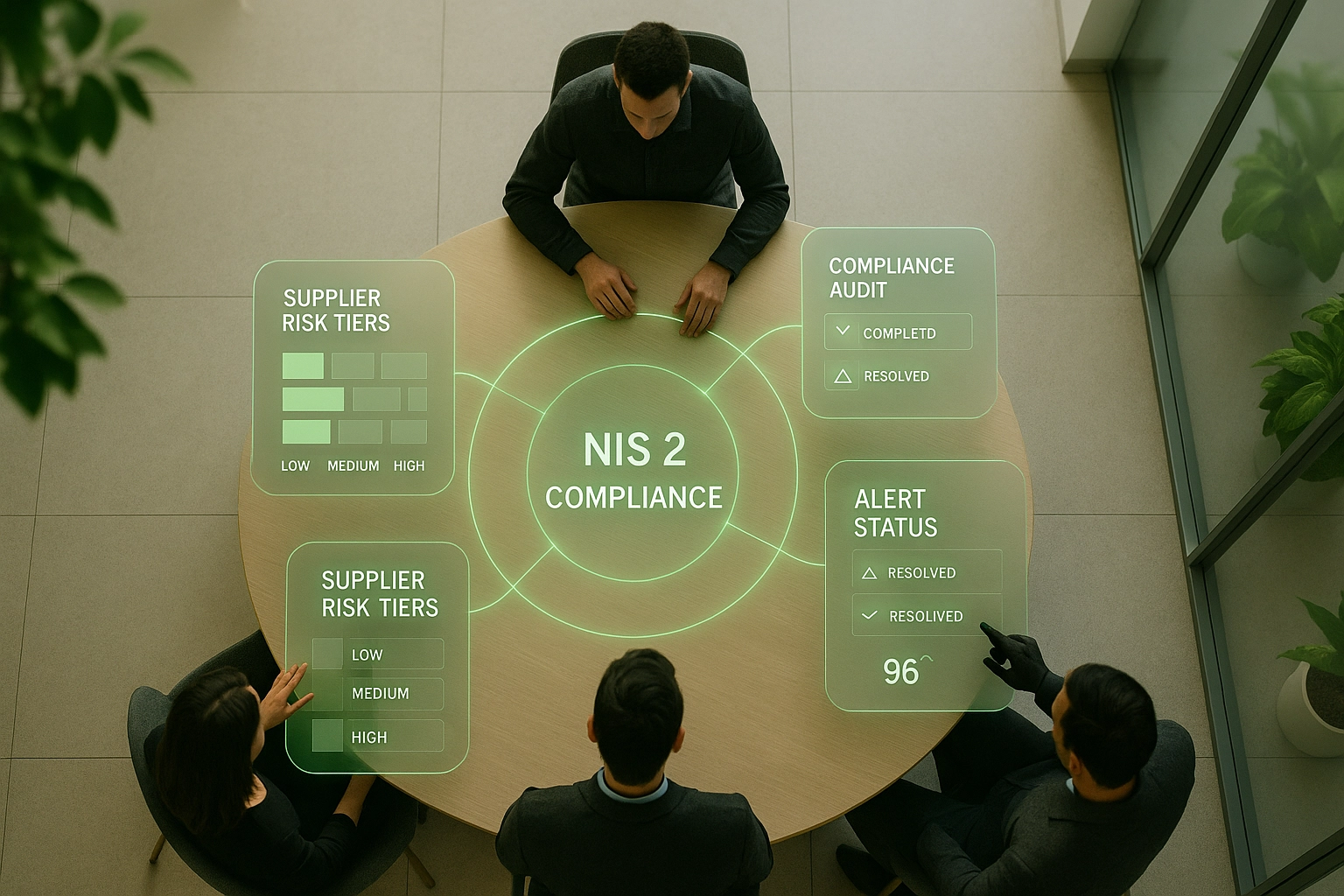

- Regulatory Compliance: Adherence to legal frameworks like DORA and NIS 2

- ESG Performance: Environmental, Social, and Governance impact aligned with CSRD criteria

- Operational Resilience: Business processes, continuity plans, and adaptability

This multidimensional approach, based on international standards, enables the creation of a comprehensive risk profile for each third party and the adaptation of control measures accordingly.

Analytical tools make it possible to automatically score and rank third parties according to their risk level. Some suppliers may pose high cybersecurity risks, while others could represent a financial threat.

Step 3: Continuous Monitoring and Proactive Surveillance

Initial assessments are just the beginning. In fast-evolving threat environments, real-time monitoring is essential. Leading organizations use layered surveillance combining:

- On-site audits for infrastructure and process inspections

- Dynamic dashboards with live Key Risk Indicators (KRIs)

- Early-warning alerts to detect anomalies proactively

- Evolving compliance checks to match regulatory updates

- Structured assessments via smart questionnaires

- Internal intelligence from enterprise systems

- External scoring from independent providers

AI and predictive analytics enhance this process by surfacing weak signals before they escalate. In sectors like construction, this enables risk-based oversight of multi-tier subcontractors. For example, subcontractors involved in structural work may require stricter certifications than those providing auxiliary services.

Aprovall360 empowers organizations to move from reactive management to proactive, integrated third-party governance.

Step 4: Risk Remediation and Anticipatory Risk Management

Effective remediation is fast, structured, and prioritized. Aprovall’s methodology includes:

- Immediate impact assessment: Analyze potential consequences and rank by criticality

- Targeted corrective actions: Deploy proportionate mitigation steps involving relevant stakeholders

- Continuous tracking: Use KPIs to measure remediation effectiveness and adapt strategies as needed

Companies are now integrating dynamic remediation plans, allowing them to quickly adapt corrective measures based on the evolving threat landscape and feedback from past incidents. In the public sector, for example, this anticipatory approach enables local authorities to maintain continuity of essential services even in the event of a critical vendor failure.

Taking a proactive approach ensures that risks are addressed before they escalate into actual threats. It also strengthens supplier relationships, fostering collaboration based on mutual trust and turning risk management into a true driver of shared performance.

Technology and Tools for Strong Third-Party Governance

Next-Generation TPRM Platforms

Modern platforms integrate AI and predictive analytics to automate identification, evaluation, and monitoring of third-party risks. These systems centralize data, provide real-time insights, and anticipate emerging threats.

Key features include interactive dashboards, predictive alerts, and intuitive workflows tailored to risk managers.

Mutualized Approach to Reduce Supplier Fatigue

TPRM technology relies heavily on the relationship with third parties. It is through the TPRM platform that organizations orchestrate interactions with their vendors. For instance, an average organization can save up to 60% of data collection time thanks to Aprovall’s mutualized approach. As such, the collection process must be practical, fast, and above all, free of charge. Today, it is unthinkable for suppliers — often SMEs with only one or two administrative staff — to spend time and money on a completion process.

With Aprovall360, organizations access a shared pool of previously collected data from third parties who’ve completed ESG, anti-corruption, or cyber risk assessments.

Seamless Integration with Enterprise Systems

TPRM solutions work best when integrated with ERP, CRM, SRM, or GRC tools. Centralizing third-party data streamlines decision-making and ensures consistency.

Best Practices for Collaborative TPRM

Partner Selection Criteria

Defining strict selection criteria is the foundation of an effective TPRM. High-performing organizations structure their selection process around five essential pillars:

- Documented security and compliance (certifications, audit trails)

- Financial strength (sustainability indicators)

- Operational maturity (internal controls, governance)

- Verified ESG metrics (CSRD-aligned, decarbonization efforts)

- Proven adaptability (crisis resilience, regulatory flexibility)

For industrial partners, assessing operational maturity is essential — particularly regarding compliance with ICPE and REACH regulations. Companies in the industrial sector that implement a structured third-party risk management framework significantly reduce environmental incidents and improve their ability to maintain operational continuity, as demonstrated by a 40% optimization in supplier certification processes.

This systematic approach, aligned with international standards, enables the identification and selection of partners who will contribute to the organization’s long-term resilience. The criteria must also be tailored to the type of service provided by the third party — an IT supplier requires different requirements than a logistics provider.

Training and Awareness of Internal Teams

The involvement of internal teams in the TPRM process is crucial to ensuring its long-term effectiveness. Regular training on third-party governance enables employees to understand the strategic stakes and proactively identify potential warning signs.

A well-trained team is your first line of defense against third-party risks. It ensures optimal coordination between the various departments involved (procurement, legal, IT, compliance) and allows for faster and more consistent responses in the event of an incident. In the public sector, for example, this training is especially important for officials in charge of public procurement, who must understand GDPR requirements applicable to external providers.

Effective training programs should cover four essential dimensions:

- Cyber threat awareness: training on techniques to identify potential vulnerabilities in partners and understanding common attack vectors in your sector

- Understanding financial risks: learning how to analyze economic health indicators of partners and detect early warning signs of financial difficulties that could affect service continuity

- Mastery of the regulatory framework: deep knowledge of applicable industry standards and specific compliance obligations, particularly important in highly regulated industries

- Operational resilience culture: developing a systemic view of the supply chain and understanding critical interdependencies between different actors

To maximize the effectiveness of this training, prioritize a blended approach combining theoretical sessions, practical exercises, and crisis simulations tailored to your industry. The most advanced organizations also integrate training modules into their TPRM tools for ongoing and contextualized learning.

Transparent Communication with the External Ecosystem

Transparent and open communication with suppliers is essential for effective TPRM. Informing partners about expectations, regulatory changes, and evaluation results can help strengthen collaboration.

This transparency fosters a relationship of mutual trust, which is crucial for ensuring compliance with the required quality and security standards.

Transition to TPGRC: The Natural Evolution of TPRM

Definition and Principles of TPGRC

Third Party Governance & Risk Compliance (TPGRC) represents a strategic evolution of TPRM. This integrated approach is becoming essential in a context where 78% of Fortune 500 companies strengthened their third-party governance in 2023. By merging governance, risk management, and compliance into a unified framework, organizations can now orchestrate all third-party interactions in a consistent and systematic manner.

TPGRC significantly expands the traditional scope of TPRM by incorporating essential complementary dimensions:

- Regulatory anticipation: Beyond basic compliance, TPGRC allows organizations to anticipate regulatory changes and proactively adapt governance processes

- Enhanced governance: Beyond simple risk management, TPGRC establishes a comprehensive governance framework that clearly defines roles, responsibilities, and decision-making processes related to third-party relationships

- Holistic vision: This approach encompasses not only security and financial aspects but also ethical, social, and environmental commitments within an integrated perspective

- Centralized data: TPGRC enables access to all third-party information (maturity, compliance, risks) through a single dashboard, facilitating analysis and decision-making

Go Further

This shift toward TPGRC delivers measurable results across all sectors. The public sector has reduced procurement-related incidents by 30%, the construction industry has accelerated vendor certification by 40%, and the industrial sector is optimizing its supply chain through intelligent workflows. These improvements show how an integrated approach transforms third-party risk management into a true competitive advantage.

Comparison Between Traditional TPRM and Advanced TPGRC

To better understand this evolution, let’s examine the key differences between these two approaches:

| Aspect | Traditional TPRM | Advanced TPGRC |

|---|---|---|

| Main focus | Risks and threats | Governance and opportunities |

| Approach | Reactive and defensive | Proactive and collaborative |

| Scope | Security and compliance | Holistic, including ESG |

| Integration | Often siloed | Integrated into business processes |

| Technology | Dedicated tools | Unified platforms |

| Regulatory focus | Basic compliance | Regulatory anticipation |

Strategic Advantages of the TPGRC Approach

Adopting a TPGRC approach offers numerous strategic advantages that go well beyond simple regulatory compliance:

- Reduction of organizational silos: All data is integrated and shared across teams (finance, compliance, procurement), enhancing collaboration and decision-making consistency

- Transformation of supplier relationships: TPGRC fosters a collaborative rather than purely transactional relationship, creating shared value and strengthening ecosystem resilience

- Proactive risk management: TPGRC enables threat anticipation and preemptive action, turning risk management into a competitive advantage

- Enhanced reputation protection: Strong third-party governance prevents associations with non-compliant or unethical partners, thereby safeguarding corporate reputation

- Operational continuity: Early identification of partner vulnerabilities ensures business continuity even during external disruptions

- Increased operational efficiency: Automated processes save time and improve information accuracy, optimizing resource allocation

By integrating TPGRC into their overall strategy, organizations transform their third-party management from a purely defensive function into a true driver of performance and innovation. This evolution is especially relevant in a context where supply chains are becoming increasingly complex and regulatory expectations continue to intensify.

Aprovall’s Approach: Expertise in Third-Party Governance

Structured Methodology for Third-Party Evaluation

Aprovall has developed a structured and systematic framework for third-party governance. This framework covers all key stages of the TPRM process, from risk identification and remediation to collaborative evaluation and continuous monitoring. Our holistic approach, naturally aligned with the transition toward TPGRC, enables organizations to turn risk management into a true competitive advantage.

Our advanced tools provide a clear, up-to-date overview of third-party relationships, based on principles of rigor, proactivity, and continuous adaptation to evolving regulatory requirements such as DORA, NIS 2, and CSRD.

Innovation and Adaptation to Regulatory Change

In a constantly shifting economic environment, mastering TPRM has become a critical driver of resilience and performance. Faced with rising cyber threats and increasingly complex supply chains, Aprovall embraces innovative approaches and continuously adjusts its methods to meet emerging challenges.

We tailor our evaluation pathways to the specific requirements of each sector—whether it’s local authorities dealing with GDPR challenges, construction firms managing multi-tier subcontractors, or industrial players operating under ICPE and REACH regulations.

Reducing Supplier Fatigue Through a Shared Evaluation Approach

Our Aprovall360 platform stands out with its unique shared evaluation model, significantly reducing supplier fatigue. By allowing organizations to reconnect with a large number of third parties who have already completed evaluation journeys, we streamline the experience for all stakeholders.

Organizations adopting our solution benefit from tangible advantages:

- Optimized supplier relationships

- Significant reduction in third-party-related incidents

- Improved operational resilience

- Strengthened regulatory compliance

Ready to transform your third-party governance approach?

Our experts look forward to speaking with you during a personalized Aprovall360 demo.

These articles might interest you

-

14 July 2024Duty of vigilance: A recent international report warns of companies’ non-compliance, particularly in FranceSolutionsThe World Benchmarking Alliancehas just published a report analyzing the practices of the 2,000 most important companies on the planet in terms of human rights due diligence. The “alarming” results show companies’ delay in this area, and French companies are far from being an exception to the rule. The countdown has begun before the European […]

14 July 2024Duty of vigilance: A recent international report warns of companies’ non-compliance, particularly in FranceSolutionsThe World Benchmarking Alliancehas just published a report analyzing the practices of the 2,000 most important companies on the planet in terms of human rights due diligence. The “alarming” results show companies’ delay in this area, and French companies are far from being an exception to the rule. The countdown has begun before the European […]Read more

-

21 April 2025NIS2: Understanding the Obligations of Critical SuppliersSolutionsThe NIS2 Directive redefines cybersecurity requirements for critical entities and their third-party governance across Europe. With over 1.8 million companies indirectly affected via their supply chains (NIS2 Quality Mark – 2025), identifying critical third parties is now a strategic imperative for key sectors like construction and public services. This regulation mandates a dynamic mapping of […]

21 April 2025NIS2: Understanding the Obligations of Critical SuppliersSolutionsThe NIS2 Directive redefines cybersecurity requirements for critical entities and their third-party governance across Europe. With over 1.8 million companies indirectly affected via their supply chains (NIS2 Quality Mark – 2025), identifying critical third parties is now a strategic imperative for key sectors like construction and public services. This regulation mandates a dynamic mapping of […]Read more

-

14 February 2025Supply Chain and Cyber Risks: How to Protect Your Supply Chain?SolutionsThe digital transformation of supply chains creates new opportunities but also exposes organizations to growing vulnerabilities. In 2025, third-party compliance assessment and management becomes a major strategic issue as 45% of global organizations will have suffered supply chain attacks, three times more than in 2021. Given this shift, third-party governance has become a top priority, especially in critical sectors such as […]

14 February 2025Supply Chain and Cyber Risks: How to Protect Your Supply Chain?SolutionsThe digital transformation of supply chains creates new opportunities but also exposes organizations to growing vulnerabilities. In 2025, third-party compliance assessment and management becomes a major strategic issue as 45% of global organizations will have suffered supply chain attacks, three times more than in 2021. Given this shift, third-party governance has become a top priority, especially in critical sectors such as […]Read more

-

03 December 2025How TPRM Solutions Help Procurement Teams Cut Administrative Workload by 25%SolutionsReducing repetitive administrative tasks is one of the top priorities for Procurement Departments—so teams can focus on strategy, performance, and supplier relationships. The current landscape only adds pressure. Procurement professionals juggle multiple demands alongside increasing risks: climate, geopolitical, social—not to mention the classic ones: financial, environmental, cybersecurity, and human rights-related. SRM tools offer a first […]

03 December 2025How TPRM Solutions Help Procurement Teams Cut Administrative Workload by 25%SolutionsReducing repetitive administrative tasks is one of the top priorities for Procurement Departments—so teams can focus on strategy, performance, and supplier relationships. The current landscape only adds pressure. Procurement professionals juggle multiple demands alongside increasing risks: climate, geopolitical, social—not to mention the classic ones: financial, environmental, cybersecurity, and human rights-related. SRM tools offer a first […]Read more